Women’s Venture Fund and Syndicate

Investing in Women-Founded and Led Startups

What It Is

A private community, investing syndicate and fund that invests in high-potential startups founded by women or serving women-focused markets — historically undercapitalized yet high-performing founders and sectors — through a diversified fund and selective deal-by-deal syndications. Members have access to ventures and venture deals where we co-invest alongside leading VCs, with low minimums and due diligence sharing on each deal.

Who It Is For

Accredited investors seeking to help close the gender gap in venture while gaining exposure to exceptional, often overlooked opportunities. A great fit if you believe funding diverse founders creates outsized returns, and investing in them is a great opportunity — and you value investing with like-minded people, with curated access and broad diversification.

Take 5 seconds. No document uploads.

It’s All About Access to Life-Changing Deals

You Get Access to Deals Led by Top VC Firms: Quality, Quantity, Diversification.

Customize Your Venture Portfolio

Build a venture portfolio to fit your goals. Alumni Ventures invests across stages and geographies, co-investing with elite firms.

- Home

Pre-seed to Later-Stage

We invest at a variety of stages, always evaluating upside vs. price. - Home

Diverse Geographies + Leads

We look for great deals everywhere and co-invest alongside a wide variety of strong lead VC firms. - Home

Due Diligence by Alumni Ventures

America's Largest Venture Firm for Individuals and an “America’s Top 20 Venture Capital Firm of 2025” (Time ’25). - Home

Favorite Sectors? We’ve got you Covered

Interested in Medicine 3.0? Strategic Tech? Women’s Founders? Early Stage AI Deals? Customize the fund and deals you want to see and add your portfolio - Home

You Decide

Invest in funds for maximum coverage. Invest deal-by-deal for maximum exposure.

Co-Invest With Elite VCs

The best ventures have their pick of lead investors — it only makes sense to invest alongside them. These firms have co-invested in many deals with Alumni Ventures:

- Home

Andreessen Horowitz

51 investments with AV - Home

Sequoia

25 investments with AV - Home

Bessemer Venture Partners

22 investments with AV - Home

Y Combinator

56 investments with AV - Home

Founders Fund

28 investments with AV - Home

Kleiner Perkins

23 investments with AV - Home

Khosla Ventures

56 investments with AV

Getting Started with Us

How You Want to Partner With Us Is Up to You.

Our Fund

- Home

Simplest Way to a Startup Portfolio

An annual fund of 20-30 high-quality diversified investments — offering you the most efficient way to build a large portfolio. - Home

Diversification Across Many Dimensions

Diversification across sector, stage, geography, and lead investor — mitigating risk while capturing the potential upside of breakthrough innovations. - Home

Leave It up to Us

Our team gets up every day to strategically deploy your capital over ~12-18 months, reserving ~20% to pursue follow-on opportunities in the most promising portfolio investments.

Our Syndicate

- Home

Real-Time Deal Flow

You see deals as we see them - about a deal a month (it ebbs and flows). Deals move fast and sometimes fill up. - Home

Access to Our Diligence Portal

Access due diligence and view "Why We Are Investing" video briefs. - Home

Hands-On Capital Management

You decide which investment opportunities are right for you and how much to invest.

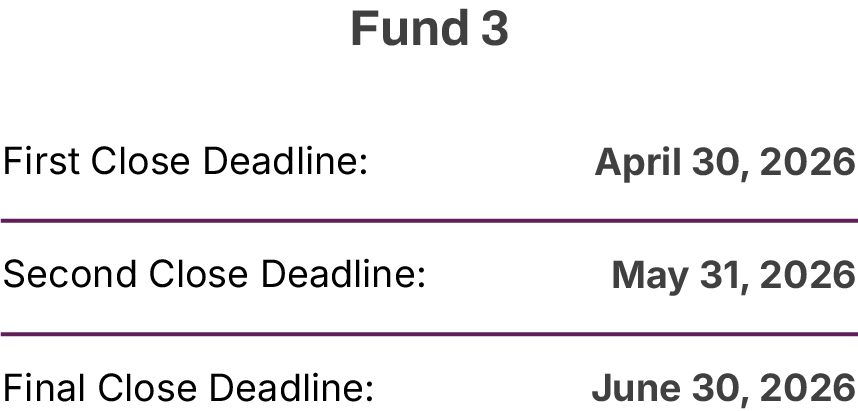

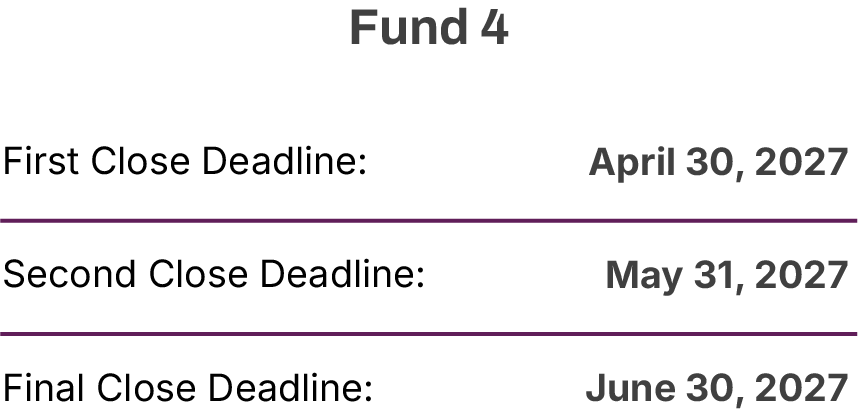

Timeline for the Annual Women’s Fund

Take 5 seconds. No document uploads.

About Alumni Ventures

- Home

Top-Tier and Battle Tested

PitchBook names AV the #1 most active VC in the U.S. (’22–’23) and CB Insights slots us in its 2024 Top 20; our 2016-20 funds sit in Cambridge Associates’ top-quartile performance ranks. - Home

Diversification From Day One

$1.4B+ deployed across 1,400+ venture-backed companies, with ~250-300 new investments added annually; diversification spreads risk and upside across stage, sector, and geography. - Home

Co-Investing With the Best

AV routinely co-invests alongside leading venture firms such as Andreessen Horowitz, Sequoia, and NEA, giving you the benefits of their negotiated terms and their support to portco companies. - Home

Network You Can Lean On

11,000 accredited investors and an 850,000-strong alumni & entrepreneur community create proprietary deal flow, talent pipelines, and follow-on capital impossible to assemble alone. - Home

Dedicated, Nationwide Team

40 full-time venture professionals spread across five U.S. offices source 50-75 fresh opportunities each quarter, vet them rigorously, and present only the deals we commit to doing for our funds.

See video policy below.

Meet Laura Rippy

See video policy below.

Laura Rippy, Managing Partner at Alumni Ventures and one of Business Insider’s top early-stage investors, leads our mission to invest in exceptional women founders. From her journey as a female CEO to building one of the strongest VC networks, Laura shares insights on why supporting female-led startups isn’t just the right thing — it’s smart investing.

Explore how the Women’s Fund backs over 400 women-led startups and helps close the funding gap, empowering visionary entrepreneurs to change the world.

Meet the Team

- Fund Team

- Scouts

- AV Support Team

Women’s Content & News

Content at the intersection of entrepreneurship, venture capital, and specific industry sectors.

Women's Portfolio

We invest alongside other established venture firms in a broad range of companies to help build you a diversified portfolio.

- Acorn Genetics

- Alba

- AllHere

- Anycart

- Appify

- Attest Technologies Limited

- Aurora Insight

- Birch

- BlastPoint

- Blaze

- BlockFi

- Bluesky

- Bluespace.ai

- BoldVoice

- Brio Systems

- Busy Co

- Cala Health

- Clarity Pediatrics

- Cleared

- Compass

- Compound

- Concerto Biosciences

- Cortina

- Cube Software

- Debbie

- Dimension

- Dough

- E25Bio

- Ellevest

- Emissary

- Emme

- Emulate

- Endless West

- Endolith Mining

- Enko Chem

- Ethena

- Forager Logistics

- Formulary

- Function Health

- Future

- Future Family

- Future/Proof

- Gatik.AI

- GC Therapeutics

- geCKo Materials

- Genome Medical

- Geospiza

- Getaround

- Glow

- Goldelocks

- Grayce

- Hatch Apps

- Hello Alfred

- Hello Alice

- HopSkipDrive

- Humio

- Hydrow

- Illumix

- Intrinio

- Juno College

- Kalder

- Kenshō

- Kindbody

- Kindest

- Kinside

- Kite AI

- Knix

- Knoq

- Kolors

- Landed

- LandIt

- Lily AI

Interested in Seeing Elite Venture Deals (for Free)?

Sign-up and receive $100 credit to the AV Swag Store, full of high-end men’s and women’s apparel and accessories.

- Home

Easy Sign-Up

Click a button. 5 seconds. - Home

No Obligation to Invest

Only invest in deals you like. - Home

Co-Invest with Elite VCs

Frequent co-investors include a16z, Sequoia, Khosla, Accel, and more. - Home

Deal Transparency

Due Diligence and Investment Memos provided. Live Deal discussions with our investment teams.