You qualify as an Accredited Investor if you meet ANY of the following:

- Home

Income

$200k annual income individually (or $300k jointly with a spouse) in each of the two most recently completed calendar years - Home

Net Worth

$1 million in individual net worth or joint net worth with a spouse - Home

Professional License

Maintaining a Series 7, Series 65, or Series 82 license in good standing with a FINRA member firm

Sign Up to Learn More

Want more details on accreditation criteria? Download A Simple Guide to Accreditation Verification

Why consider Alumni Ventures?

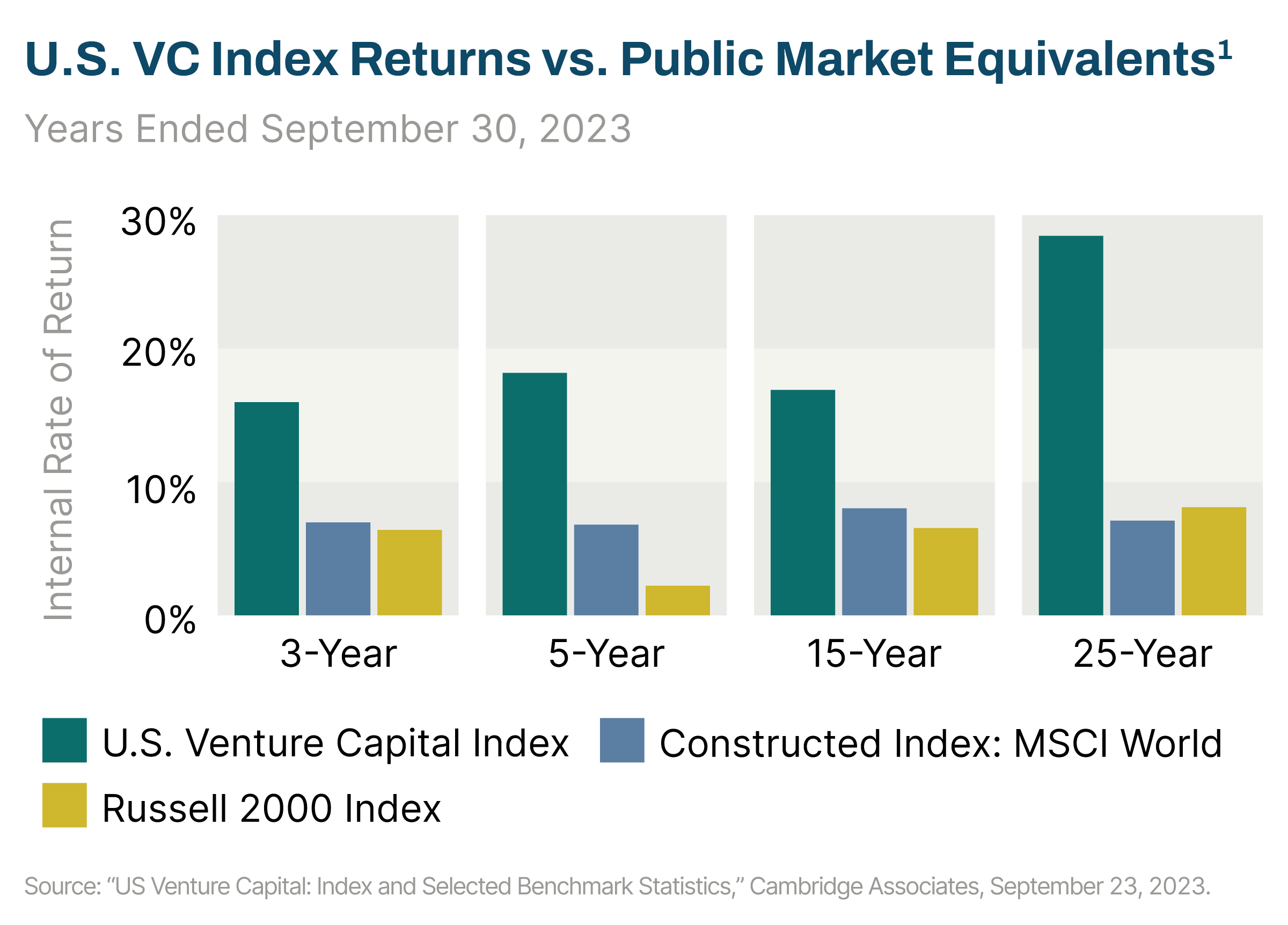

- HomeOur fund significantly outperform public market equivalents.

- HomeAV’s annualized IRR on all investments from 2014 - 2020 is 16.1% (compared to 9.5% for the S&P and 6.6% for the Russell 2000) (3)

- HomeWe are America’s largest venture firm for individual investors.

- HomeOver $1.1B capital raised from 9,000+ individual accredited investors

- Home#1 most active venture firm in the U.S. (Pitchbook 2022)

Book a 15-minute Intro Call to Learn More

Our Story, told by Founder & CEO, Mike Collins

- HomeFounded in 2014

- HomeMission: Democratize Venture Capital

- HomeProfessional-Grade Venture Portfolios

- Home#1 Most Active Venture Firm in the U.S.

See video policy below.

A Venture Fund for Every Objective

Explore Our Fund Types

(1) The aggregate performance of the AV venture funds is not necessarily representative of the performance of any particular AV venture fund or the experiences of any individual AV investor. All investment involves risk, including risk of loss. Not all venture capital investments will be successful. Past performance is not necessarily reflective of future results, and achievement of investment objectives, including preservation of principal, cannot be guaranteed. RR for AV Funds is net of management fees, and net of incentive allocations applied to amounts distributed to investors, but gross of incentive allocations applicable to unrealized gains on investments held by AV Funds. IRR for AV Funds includes Uninvested Cash, Unrealized Investments, and Amounts Distributed to Investors. For additional information, please see here.

(2) The IRR shown for Nasdaq Composite, S&P 500, and Russell 2000 indices are gross fees because indices are not managed investments. It is not possible to invest directly in an index.

(3) The information and data provided herein (the “data”) is the proprietary property to Cambridge Associates, LLC, S&P Dow Jones Indices LLC and/or their respective affiliates (together, the “Data Provider”). Cambridge Associates, LLC and/or its affiliates calculate and administer the data, but are not authorized as “administrators” under any relevant benchmark regulations or principles and the data cannot be used as a “benchmark” under such regulations or principles. The data has been licensed for use in connection with the fund (or other investment vehicle) or securities referenced herein (“Fund”}. The Fund is not sponsored, endorsed or promoted by the Data Provider. The Data Provider does not make any warranties or representations as to the accuracy, fitness for purpose or results to be obtained by using the data and disclaims all liability in this regard. The data is further subject to the disclaimer available here.