Venture Curious?: Demystifying Venture Capital for the Aspiring Venture Investor

Venture capital (VC) is often seen as a mysterious and exclusive corner of the financial world. But at its heart, it’s simple: investing in innovation to create value. From early investments in Uber to the AI revolution, many of today’s top companies and technologies are being funded by venture firms and their investors.

In this blog, I’ll walk you through the basics of VC — what it is, how it works, and why you too might find it the perfect addition to your investment portfolio.

What Is Venture Capital?

Venture capital is about funding young, tech-focused, high-growth companies. These companies are privately owned, so you can’t invest via the public market. In return for your investment, you typically get an equity stake in the company — ownership shares. The goal is to invest early, when shares cost less, and reap the rewards later as these companies grow and your ownership shares increase in value.

Interestingly, companies today are staying private longer, meaning much of their value is created before they ever go public. As an investor, ignoring this part of the market could mean missing where the real action is.

What Kind of Ventures and Venture Funds Are Out There?

Most venture deals involve startups with innovative tech or business models. The sectors VCs invest in are quite broad. They range from healthtech to fintech, biotech, AI and machine learning, cleantech and sustainable solutions, consumer products and services, media and entertainment, edtech, spacetech and aerospace, enterprise solutions, and more.

As for the funds, they might focus on a stage of funding — seed stage, early, growth, etc. Or they might focus on themes or sectors. At Alumni Ventures, we offer both those types, plus general diversified funds with portfolios that range across stages and sectors.

Seed, Early, Growth — What’s the Difference?

Explore the key stages of venture capital investing. Discover how each stage presents distinct opportunities for building a diversified portfolio.

What Are the Costs and Risks? And What Might Be the Payout?

If you’re investing in a venture fund, you’ll pay management fees to the fund manager, plus a share of the profits the fund generates (this is called “carry”).

You should know as well that typically venture is a long-term commitment of up to ten years, sometimes more. You will have few opportunities to get your money back until the company goes public or merges with or is acquired by another.

And venture is high risk, with many companies failing. But your successes can have huge payoffs. Many of the most valuable companies today, from Apple to OpenAI, started with venture funding. Returns for early investors in companies like Facebook, Uber, Airbnb, WhatsApp, Stripe, and TikTok are reported to have ranged from 50x to 10,000x depending on the deal and the investor. Yes, these are the trophy case investments, but it indicates what venture investors are aiming for. Not modest base hits, but home runs.

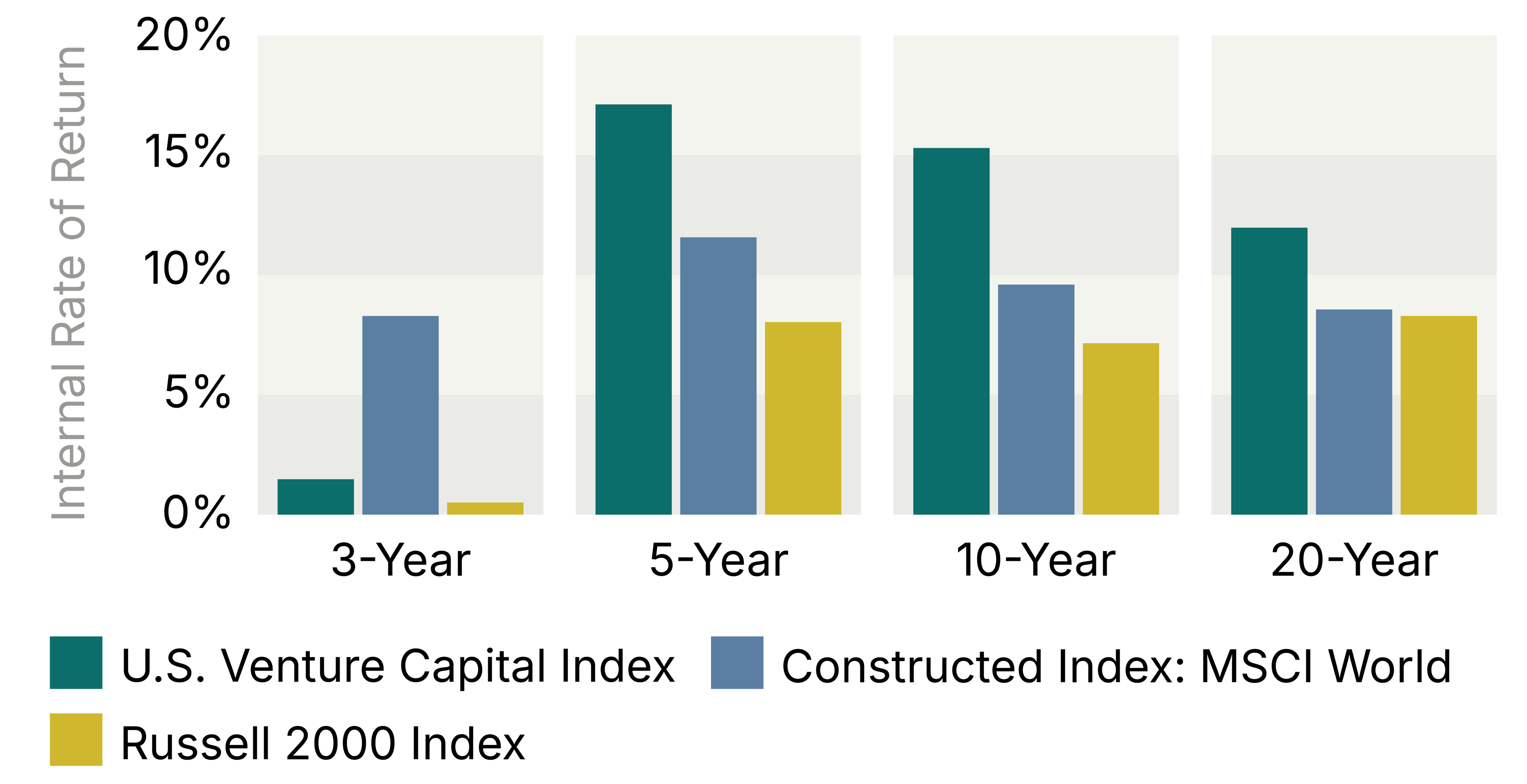

And how does venture compare to the public market? It’s outperformed public market equivalents in the 3-, 5-, 15-, and 25-year periods ending Sep. 30, 2023.

U.S. VC Index Returns vs. Public Market Equivalents1

Years Ended March 31, 2024

- Pooled horizon return, net of fees, expenses, and carried interest.

- CA Modified Public Market Equivalent (mPME) replicates private investment performance under public market conditions. The public index’s shares are purchased and sold according to the private fund cash flow schedule, with distributions calculated in the same proportion as the private fund, and mPME NAV is a function of mPME cash flows and public index returns. “Value-Add” shows (in basis points) the difference between the actual private investment return and the mPME calculated return. Refer to Methodology page for details.

- Constructed Index: MSCI World/MSCI All Country World Index: Data from 1/1/1986 to 12/31/1987 represented by MSCI index gross total return. Data from 1/1/1988 to present represented by MSCI ACWI gross total return.

Why Depth and Breadth Matter

I often tell prospective investors that I don’t view venture capital as gambling. For me, it’s a strategy.

That strategy starts with considering my overall investment portfolio and how much I want to allocate to venture. Since venture returns are only loosely correlated to public market returns, it can provide an attractive balance.

Then I think about my venture portfolio size. A portfolio of just a few companies? That’s too risky for me. Venture investing is a power law asset, meaning that most of your returns come from a few really big hits. I aim for a sizable portfolio of 50+ venture companies.

Venture Glossary: Useful VC Terms to Know

Valuation: The monetary worth of a company as determined by the market or investors. It reflects the company’s potential for growth and profitability.

Equity: Ownership in a company, typically expressed as shares. Investors receive equity in exchange for their investment, representing a stake in the company’s success or failure.

Carried Interest (Carry): A percentage of the profits earned by venture capitalists or fund managers as payment for their management, usually above a specified return threshold.

Term Sheet: A document outlining the key terms and conditions of a proposed investment. It includes details like valuation, equity stake, and investor rights.

Runway: The amount of time a company can operate before it runs out of cash, based on its current burn rate (monthly expenses). A longer runway is typically better for startups.

Dilution: The reduction of existing shareholders’ ownership percentages when new shares are issued, often as a result of additional funding rounds.

Exit Strategy: A plan for investors and founders to realize a return on investment, through an acquisition, merger, or IPO (Initial Public Offering).

I also mitigate risk by diversifying my investments over stage and sector. So if the wind goes out of a sector or a stage of investing, my whole venture portfolio isn’t impacted.

That’s where the power of diversification shines. At Alumni Ventures, we emphasize building diversified portfolios across sectors, geographies, and stages of growth. It’s how we manage risk while giving our investors access to the most exciting opportunities.

Why Venture Capital Matters

The value created by venture-backed companies isn’t just financial — it’s transformational. From life-saving biotech innovations to world-changing technologies like AI and robotics, these startups drive progress and offer the potential for outsized profits.

Major institutions like university endowments and family offices (who manage money for very wealthy families) consistently allocate to venture capital. They know it’s where innovation and economic growth happen.

It’s also an investment that offers more than monetary returns. It provides insights into emerging trends, new industries, and where the world is heading.

Key Questions to Ask Yourself Before Investing

- HomeWhat are my investment goals and is VC a good for those and my overall portfolio?

- HomeWhat is my risk tolerance? Can I afford to lose a portion—or potentially all—of the capital I invest in VC?

- HomeWhat is my financial position and time horizon? Can I afford to have my money locked up for perhaps 7-10 years?

- HomeDo I understand and am comfortable with how VC works?

- HomeWhat level of control and involvement do I want?

- HomeDo I have access to quality opportunities?

The Alumni Ventures Approach

I personally find venture investing exciting, fun, and sometimes profitable. But finding and then vetting great deals on your own is tough.

That’s why I started Alumni Ventures, to solve a personal pain point that I felt others shared: easy access to venture deals. I wanted to change that, creating a platform for individual investors to access smart, simple, and value-creating venture capital.

My conviction that it was a collective pain point proved out. Over the past decade, we’ve attracted 10,000+ investors and grown into one of the most active VC firms globally, co-investing alongside leading firms like Andreessen Horowitz and Sequoia.

Our model is built for accredited investors looking to add venture capital to their portfolios. We provide education, transparency, and community, helping you make informed decisions and become a confident investor. Whether you’re a tech enthusiast, legacy builder, or simply curious, our platform meets you where you are.

Why Now Is the Time

The next decade will bring seismic shifts in sectors like AI, energy, and life sciences. These changes will create winners, disruptors, and massive opportunities for those who are prepared. If you’re venture curious, now is the time to take the next step. Start small, diversify, and make VC a meaningful part of your long-term wealth-building strategy.

Getting Started

For those new to venture capital, our Foundation Fund is a great place to begin. It offers a diversified portfolio of companies sourced across our funds, providing exposure to early- and later-stage opportunities. It’s a simple, powerful way to invest in the future while staying grounded in sound investment principles.

Let’s build something great together. At Alumni Ventures, we’re not just investing in companies— we’re investing in the future.

Learn More About the Foundation Fund

~20-30 investments diversified by stage, sector, geography, and lead investor. Deployed over 12-18 months.

Max Accredited Investor Limit: 249

Michael Collins

CEO, Alumni VenturesMike has been involved in almost every facet of venturing, from angel investing to venture capital, new business and product launches, and innovation consulting. He is the CEO of Alumni Ventures and launched AV’s first alumni fund, Green D Ventures, where he oversaw the portfolio as Managing Partner and is now Managing Partner Emeritus. Mike is a serial entrepreneur who has started multiple companies, including Kid Galaxy, Big Idea Group (partially owned by WPP), and RDM. He began his career at VC firm TA Associates. He holds an undergraduate degree in Engineering Science from Dartmouth and an MBA from Harvard Business School.

This communication is from Alumni Ventures, a for-profit venture capital company that is not affiliated with or endorsed by any school. It is not personalized advice, and AV only provides advice to its client funds. This communication is neither an offer to sell, nor a solicitation of an offer to purchase, any security. Such offers are made only pursuant to the formal offering documents for the fund(s) concerned, and describe significant risks and other material information that should be carefully considered before investing. For additional information, please see here. Venture capital investing involves substantial risk, including risk of loss of all capital invested. Past performance does not guarantee future results, and achievement of investment objectives, including any multiple of return on invested capital, cannot be guaranteed. This communication includes forward-looking statements, generally consisting of any statement pertaining to any issue other than historical fact, including without limitation predictions, financial projections, the anticipated results of the execution of any plan or strategy, the expectation or belief of the speaker, or other events or circumstances to exist in the future. Forward-looking statements are not representations of actual fact, depend on certain assumptions that may not be realized, and are not guaranteed to occur. Any forward-looking statements included in this communication speak only as of the date of the communication. AV and its affiliates disclaim any obligation to update, amend, or alter such forward-looking statements, whether due to subsequent events, new information, or otherwise.