Reflections on 2024 and Predictions for 2025

The Venture Capital Industry’s Path Forward

The venture capital industry in 2024 showed resilience, with steady investment growth following previous challenges, and a recalibration of founder-investor dynamics creating clearer paths to profitability. Looking ahead to 2025, optimism returns with favorable regulatory changes and market conditions, alongside emerging opportunities in technology sectors such as AI, life sciences, and sustainable energy.

As the new year dawns, it’s the perfect moment to step back from the daily pace of business and take stock of the broader dynamics shaping the venture capital and technology ecosystems. This blog explores key trends, challenges, and opportunities that defined 2024 and looks ahead to what investors and innovators can expect in 2025.

Resilience in the “New Normal”

The venture capital industry in 2024 demonstrated its hallmark resilience. Following the challenges of 2022 and 2023, modest growth in venture deployment signaled renewed founder confidence and an attractive environment for investing fresh capital. While legacy investments continue to face hurdles, reset valuations and investor-friendly terms have set the stage for compelling opportunities.

Unlike the V-shaped rebounds of other past cycles, this recovery has been more measured. Recognizing this, we maintained a steady investment pace through uncertain periods, avoiding reactive cutbacks. The accompanying chart underscores the value of consistency, tracking venture deployment from 2015 to today and showing the pandemic-era distortions gradually reverting to historical norms.

Capital Deployed in the U.S., 2015–2024

SOURCE: VC Industry Data from PitchBook, November 2024.

The aberrations of 2021—driven by aggressive fiscal and monetary policies—created a historic surge in venture capital activity. Yet, the industry’s ability to stabilize post-disruption reaffirms its adaptability. What’s described as a “New Normal” is, in essence, the market realigning with pre-pandemic trends—a testament to its ability to mean revert.

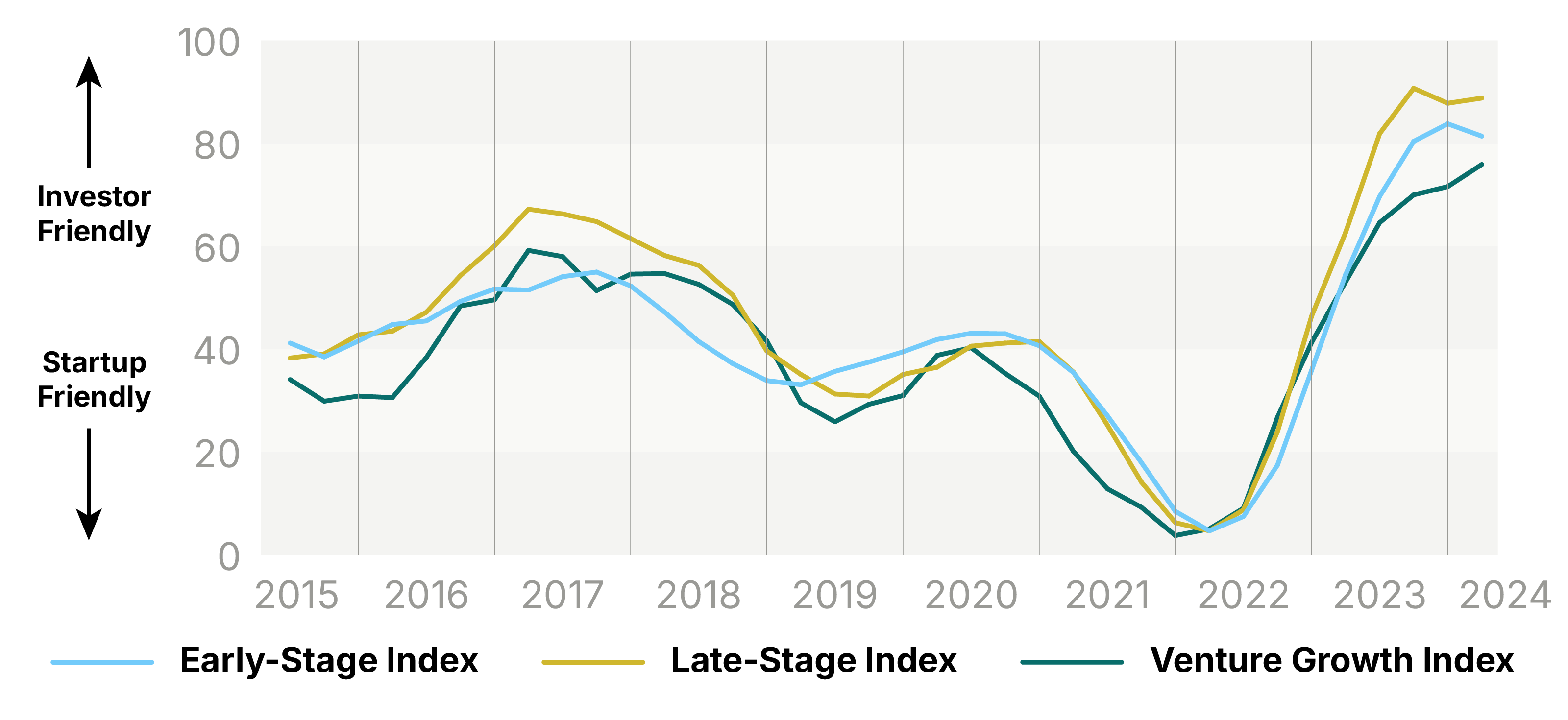

A Reset in Founder-Investor Dynamics

One silver lining of the recent market correction has been the recalibration of founder-investor dynamics. Scarcity of capital in 2023 and 2024 created an environment where terms favored investors, leading to reset valuations, enhanced governance rights, and a renewed emphasis on capital efficiency. This environment has fostered deeper alignment between investors and founding teams, with clearer paths to profitability now a shared priority.

Most Investor-Friendly Environment of Last Decade

U.S. VC Dealmaking Indicator by Quarter

SOURCE: “PitchBook VC Dealmaking Indicator,” PitchBook, May 7, 2024. Data as of April 30, 2024.

Looking to 2025

As we turn to 2025, guarded optimism has returned. The incoming administration’s focus on reduced regulation, favorable tax policies, and a laissez-faire approach to crypto could unlock new avenues for innovation and growth. Additionally, the potential reopening of IPO and M&A markets is poised to offer critical liquidity pathways.

Notably, the Goldman Sachs IPO Issuance Barometer, at 137 (vs. a baseline of 100), signals the most favorable conditions for public offerings since 2021. Recent IPOs, like ServiceTitan’s $625 million raise at a now $9.6 billion market cap, demonstrate the appetite for well-positioned venture-backed businesses. Such exits could catalyze renewed momentum across the ecosystem, boosting confidence among investors and founders alike.

Private Markets: Shelter From the Storm

I like to draw the analogy comparing investment markets to the ocean. On the ocean’s surface, variables like wind and tide can quickly stir up storms and create incredible tumult. But deeper in the water column, an environment of greater calm and consistency prevails. Similarly, compared to the volatility of public markets, private investments provide relative stability. The long-term perspective afforded by this dynamic enables venture investors to focus on nurturing transformative ideas and supporting exceptional entrepreneurial talent independent of conditions “on the surface.”

The current technology landscape is brimming with opportunities, driven by what we believe is the early phase of an innovation supercycle. From advancements in AI to breakthroughs in life sciences, robotics, and sustainable energy, these innovations have the potential to redefine industries and reshape everyday life.

Closing Thoughts

As we navigate into 2025, humility remains essential. While the journey ahead holds uncertainties, it’s a privilege as venture capitalists to support bold founders and groundbreaking companies. By remaining steadfast in our investment discipline and aligned with long-term trends, we are excited about the potential to drive meaningful impact and generate extraordinary value for our investors in the years ahead.

Learn More About the Foundation Fund

~20-30 investments diversified by stage, sector, geography, and lead investor. Deployed over 12-18 months.

Max Accredited Investor Limit: 249

This communication is from Alumni Ventures, a for-profit venture capital company that is not affiliated with or endorsed by any school. It is not personalized advice, and AV only provides advice to its client funds. This communication is neither an offer to sell, nor a solicitation of an offer to purchase, any security. Such offers are made only pursuant to the formal offering documents for the fund(s) concerned, and describe significant risks and other material information that should be carefully considered before investing. For additional information, please see here. Example portfolio companies are provided for illustrative purposes only and are not necessarily indicative of any AV fund or the outcomes experienced by any investor. Example portfolio companies shown are not available to future investors, except potentially in the case of follow-on investments. Venture capital investing involves substantial risk, including risk of loss of all capital invested. This communication includes forward-looking statements, generally consisting of any statement pertaining to any issue other than historical fact, including without limitation predictions, financial projections, the anticipated results of the execution of any plan or strategy, the expectation or belief of the speaker, or other events or circumstances to exist in the future. Forward-looking statements are not representations of actual fact, depend on certain assumptions that may not be realized, and are not guaranteed to occur. Any forward-looking statements included in this communication speak only as of the date of the communication. AV and its affiliates disclaim any obligation to update, amend, or alter such forward-looking statements, whether due to subsequent events, new information, or otherwise.