Kalder: Reinventing Loyalty Programs with Payments, Partnerships, and Profitability

Reward and Monetize Top Customers with Partner Rewards

Customer loyalty is critical to the growth of any business. We believe that customer loyalty is undergoing a major transformation driven by technology, data, and changing consumer expectations. AI is enabling hyperpersonalized rewards, predictive customer behavior analysis, and dynamic engagement strategies.

Moreover, consumers no longer just want points; they want exclusive experiences, social recognition, and deeper brand relationships. Platforms that power experiential rewards, gamification, and community-driven loyalty are thriving. However, not every brand is equipped to build a compelling loyalty and rewards platform. This is why Triphammer Ventures is excited to announce our investment in Kalder.

Lucas Kirshenbaum

Senior AnalystLucas began his career in finance as a Summer Analyst at JANA Partners, the NYC-based activist hedge fund. The subsequent year, he conducted buy-side equity research for Thomas H. Lee - one of the early pioneers in private equity and leveraged buyouts. Upon graduating Cum Laude from Cornell University with a B.S. in Business Management and Entrepreneurship, Lucas joined Barclays Investment Bank as an Equity Research Analyst, covering Consumer Hardlines and Broadlines.

Imagine this: You’re the marketing director of a leading luxury hotel brand, tasked with increasing customer loyalty and repeat bookings. Your current loyalty program feels outdated: members earn points but they lack flexibility or relevance, leading to declining engagement. You know you need a cutting-edge solution to retain your customers, boost revenues, and stay competitive in the $38B loyalty program market.

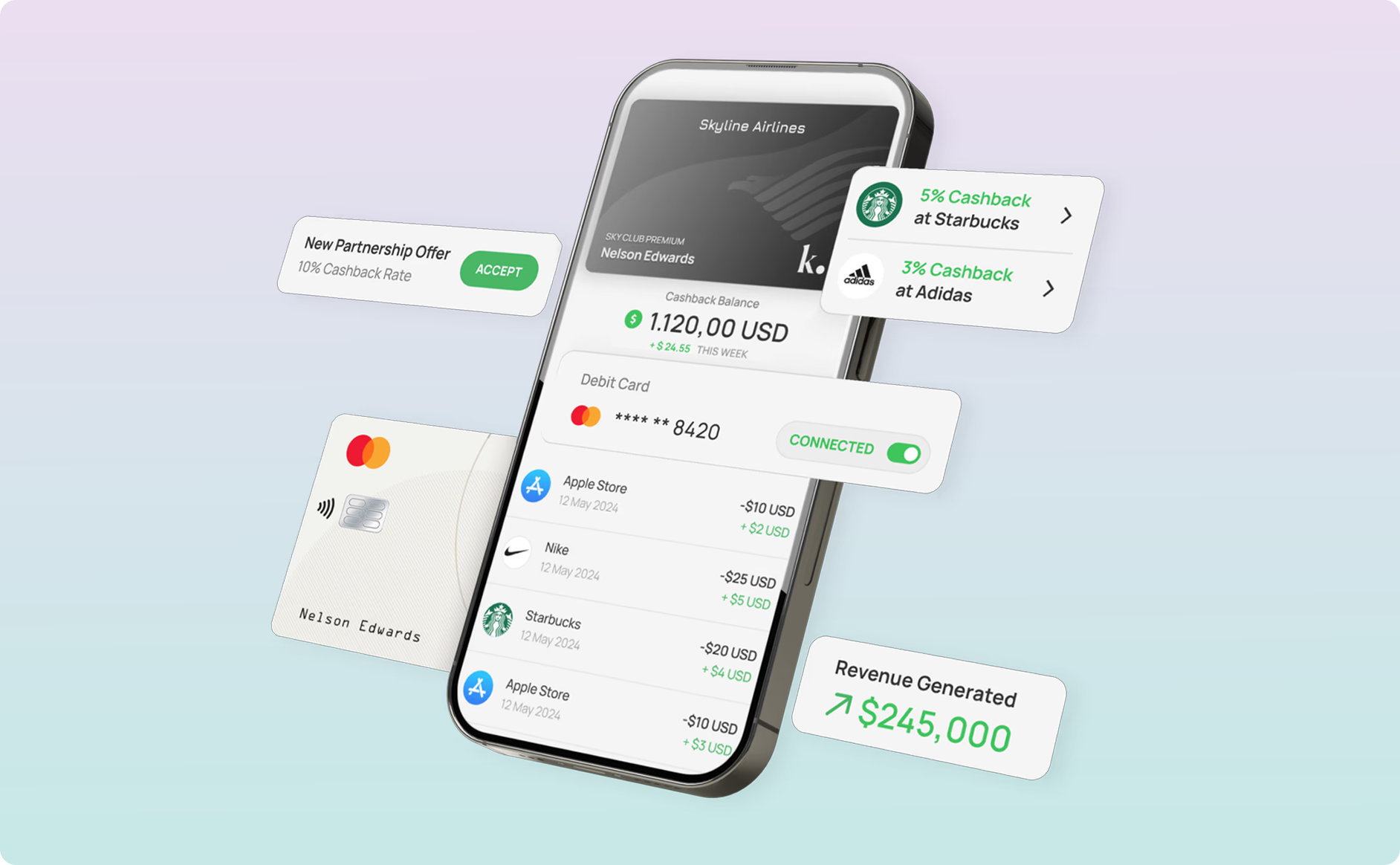

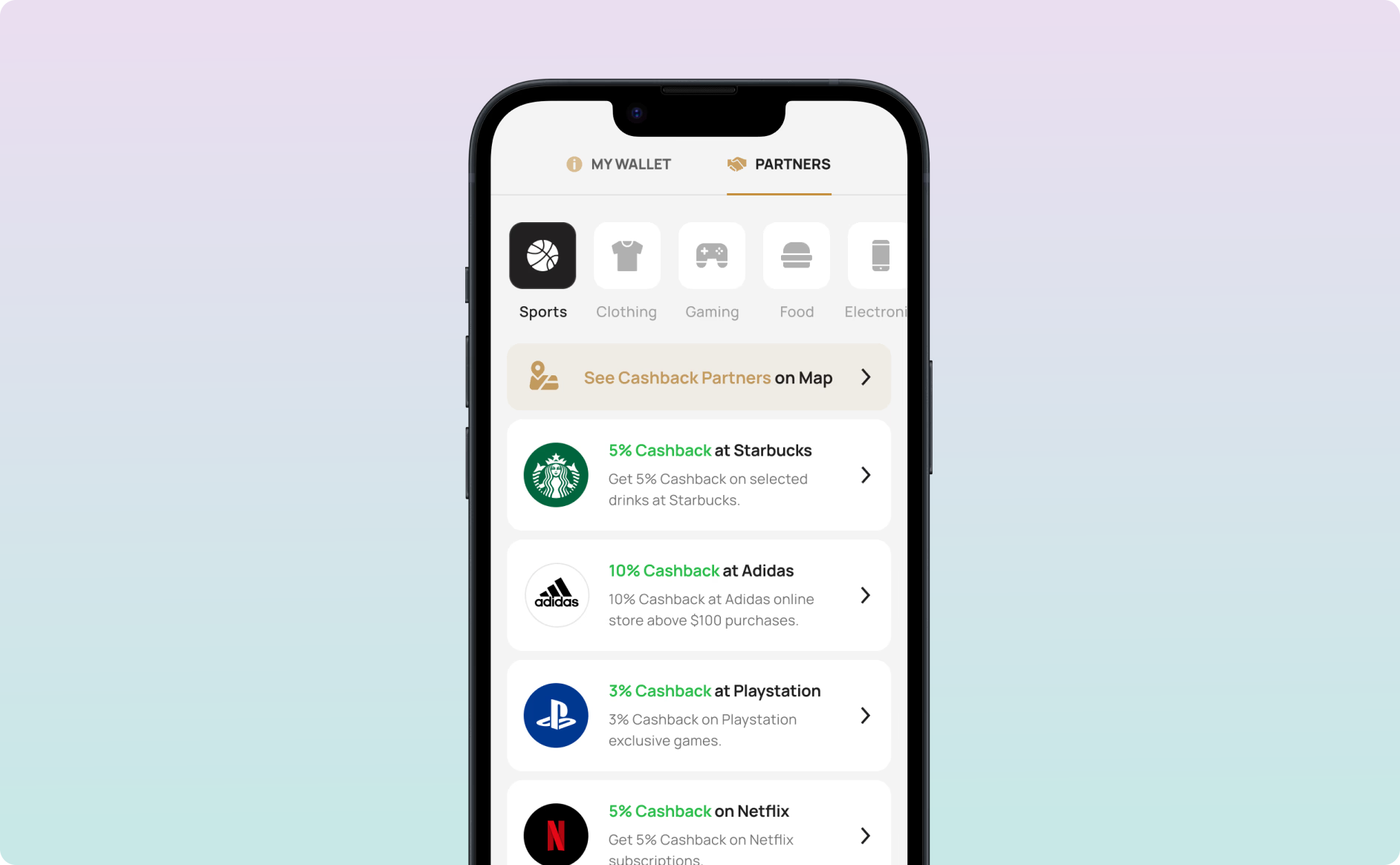

That’s where Kalder comes in. Kalder’s platform helps brands create, scale, and monetize next-generation loyalty programs. From enabling branded wallets and co-branded debit cards to powering a seamless reward exchange system, Kalder addresses critical gaps in traditional loyalty programs. Brands using Kalder have seen increased customer engagement, significant revenue uplift, and an entirely new dimension of monetization through loyalty rewards.

Kalder also introduces the industry’s first loyalty partner exchange, allowing brands to collaborate and let customers swap points between partner programs. Hotel guests could exchange their points for airline miles or sports fans redeem rewards for discounts at partner brands like Nike. This functionality not only enhances customer satisfaction but also creates a network effect, with one brand bringing in additional partners, amplifying Kalder’s reach and value.

Additionally, the platform’s ability to integrate branded payment wallets adds a fintech component that unlocks even more value for brands, akin to how Starbucks Rewards has transformed loyalty programs into a financial engine.

The company has achieved impressive traction and is already working with 100+ active brands, including names like Godiva, IATA, and MILE.

Kalder’s leadership team brings exceptional experience. CEO Gökçe Güven, who previously held key product roles at Robinhood and OpenSea, has deep expertise in payments and wallets. Her track record in crafting user-friendly fintech solutions has been the driving force behind Kalder’s innovative approach. In recognition of her outstanding contributions, Gökçe was recently featured on the cover of Forbes’ prestigious 30 Under 30 list in Marketing & Advertising, highlighting Kalder’s groundbreaking work in “rewriting the rules of brand engagement.”

When asked about her 2025 outlook for Kalder, Gökçe Güven emphasized how “2025 will be the year of the flywheel for Kalder. When a brand launches a partner rewards program with us, they bring in offer partners. Those offer partners then see the value and start their own programs, bringing in even more partners. This compounding network effect turns loyalty into a high-growth revenue channel — every new partner strengthens the entire ecosystem. Brands earn more, customers engage more, and rewards become a seamless part of everyday spending. In 2025, loyalty will not be just about points anymore — it will be about profit. Kalder will be the main backend network making this transformation effortless.”

Alumni Ventures is proud to be one of an outstanding group of investors participating in Kalder’s recent $7M Seed round led by Javelin Venture Partners. Noah Doyle, Javelin’s lead partner, brings exceptional expertise in loyalty programs, drawing on his experience as the co-founder of MyPoints.com, once the largest internet loyalty program of its era.

In summary, Kalder is transforming the loyalty program space with a highly scalable and differentiated platform that integrates payments, rewards, and partnerships. With strong early traction, a highly efficient business model, and backing from leading investors, Kalder is positioned to redefine how brands engage and retain their customers while unlocking entirely new revenue streams.

Want to learn more?

View all our available funds and secure data rooms, or schedule an intro call.

New to AV?

Sign up and access exclusive venture content.

This communication is from Alumni Ventures, a for-profit venture capital company that is not affiliated with or endorsed by any school. It is not personalized advice, and AV only provides advice to its client funds. This communication is neither an offer to sell, nor a solicitation of an offer to purchase, any security. Such offers are made only pursuant to the formal offering documents for the fund(s) concerned, and describe significant risks and other material information that should be carefully considered before investing. For additional information, please see here. Example portfolio companies are provided for illustrative purposes only and are not necessarily indicative of any AV fund or the outcomes experienced by any investor. Example portfolio companies shown are not available to future investors, except potentially in the case of follow-on investments. Venture capital investing involves substantial risk, including risk of loss of all capital invested. This communication includes forward-looking statements, generally consisting of any statement pertaining to any issue other than historical fact, including without limitation predictions, financial projections, the anticipated results of the execution of any plan or strategy, the expectation or belief of the speaker, or other events or circumstances to exist in the future. Forward-looking statements are not representations of actual fact, depend on certain assumptions that may not be realized, and are not guaranteed to occur. Any forward-looking statements included in this communication speak only as of the date of the communication. AV and its affiliates disclaim any obligation to update, amend, or alter such forward-looking statements, whether due to subsequent events, new information, or otherwise.