Infographic: How Fees Work in a Typical Alumni Ventures Fund

The Alumni Ventures family of funds encompasses Alumni Funds, Total Access Funds, Focused Funds, Opportunity Funds, and Syndication Funds, all tailored towards the individual investor.

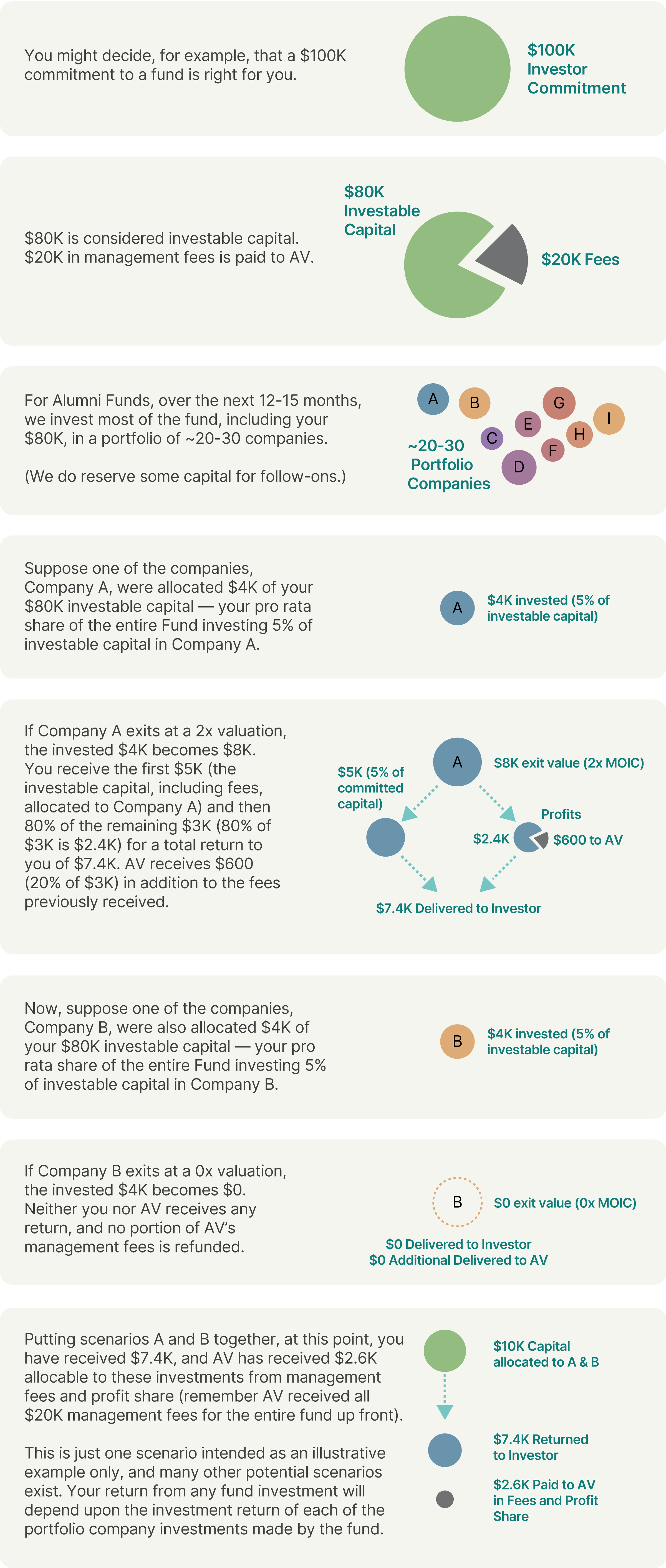

Different funds have different fee structures. Some Funds follow a Fund Carry model, while others follow a Deal Carry model. The infographics below lay out how our fees are structured in each case and what to expect if you choose to invest with us. For more details, you can review our Fees and Profit-Sharing policy document. Refer to your specific fund subscription agreements for details on the carry treatments for your specific funds and product offerings.

Three Things to Know about AV Fees

- HomeAlumni Ventures charges the equivalent of a 2% management fee for the fund’s 10-year term — 20% of the capital commitment — upfront.

- HomeFor Fund Carry, after all of the initial capital (including fees) is returned to investors, profits are shared 80% to investors and 20% to AV. For Deal Carry, with respect to each individual portfolio company investment made by the fund, after the capital, including fees, allocable to that investment is returned to investors, profits are shared 80% to investors and 20% to AV. This calculation is repeated for each investment made by the fund. In this calculation, AV earns a profit on those investments that are profitable regardless of the overall performance of the fund.

- HomeInvestors contribute their capital to the fund only once, within the fundraise window. There are no additional management fees, even if funds are extended beyond 10 years.

Fund Carry

Fee Structure for Typical Alumni and Total Access Funds

Deal Carry

Fee Structure for Typical Focused and Multi-Asset Syndication Funds

NOTE: With Deal Carry, while the success of individual investments could offset losses from others so that overall your Fund investment is profitable, AV might receive profit share even if your capital commitment and management fees are not returned in full.

Frequently Asked Questions

FAQ

No, we do not charge any other “soft” costs to cover travel, fund formation, accounting, or other admin-related expenses.

Yes, we reward investors with loyalty payments as they commit more to AV. We currently offer loyalty reward payments to investors who commit more than $500K in capital. (Fee policies are not retroactive and are subject to change. Loyalty rewards payments are subject to taxation, and investors with a payment of $600+ should expect to receive a coinciding 1099 form for tax purposes.) Loyalty Reward checks are issued to the individual investor, regardless of the method of investment.

We collect capital just once at the beginning of each investment because it’s efficient, transparent, and convenient for our investors. It lets us focus on what you pay us for: accessing promising venture deals. We also deploy capital quickly, investing most of it within 12-15 months. AV collects its management fee when you invest and reserves a designated portion to cover future potential needs of the funds.

For any Fund investment that wraps up earlier than 10 years, if we’ve not returned your entire committed capital (including fees), a non pro-rata portion of fees will be returned to you. See Fund legal documents for additional details.

Want to learn more?

View all our available funds and secure data rooms, or schedule an intro call.

New to AV?

Sign up and access exclusive venture content.

Contact [email protected] for additional information. To see additional risk factors and investment considerations, visit av-funds.com/disclosures.