Webinar

Alumni Ventures’ Fall RIA Educational Series

Part 1: Exploring the Benefits of Venture In Wealth Management Portfolios

In the first part of AV’s introductory VC series for the wealth management community, Head of Business Development Jack Barlow and Managing Partner David Shapiro will explore how wealth managers can benefit from incorporating venture capital in client portfolios.

See video policy below.

Post Webinar Summary

The speakers provide an overview of Alumni Ventures’ investment strategies, emphasizing their diversified approach, which spans sectors, stages, and geographies. They offer several solutions, including a core diversified model, a mid-stage follow-on strategy, and thematic programs for sector-specific exposure. They discuss the shift toward more investor-friendly valuations, noting that current market conditions present better entry points compared to the high valuations seen from 2018-2021. They operate both direct-to-investor and institutional private market funds. Alumni Ventures follows a generalist model but leverages deep expertise across sectors like health tech, AI, and fintech through both their internal team and a broad network of experts. The session concludes by encouraging attendees to engage in upcoming events focused on underwriting venture deals and market trends.

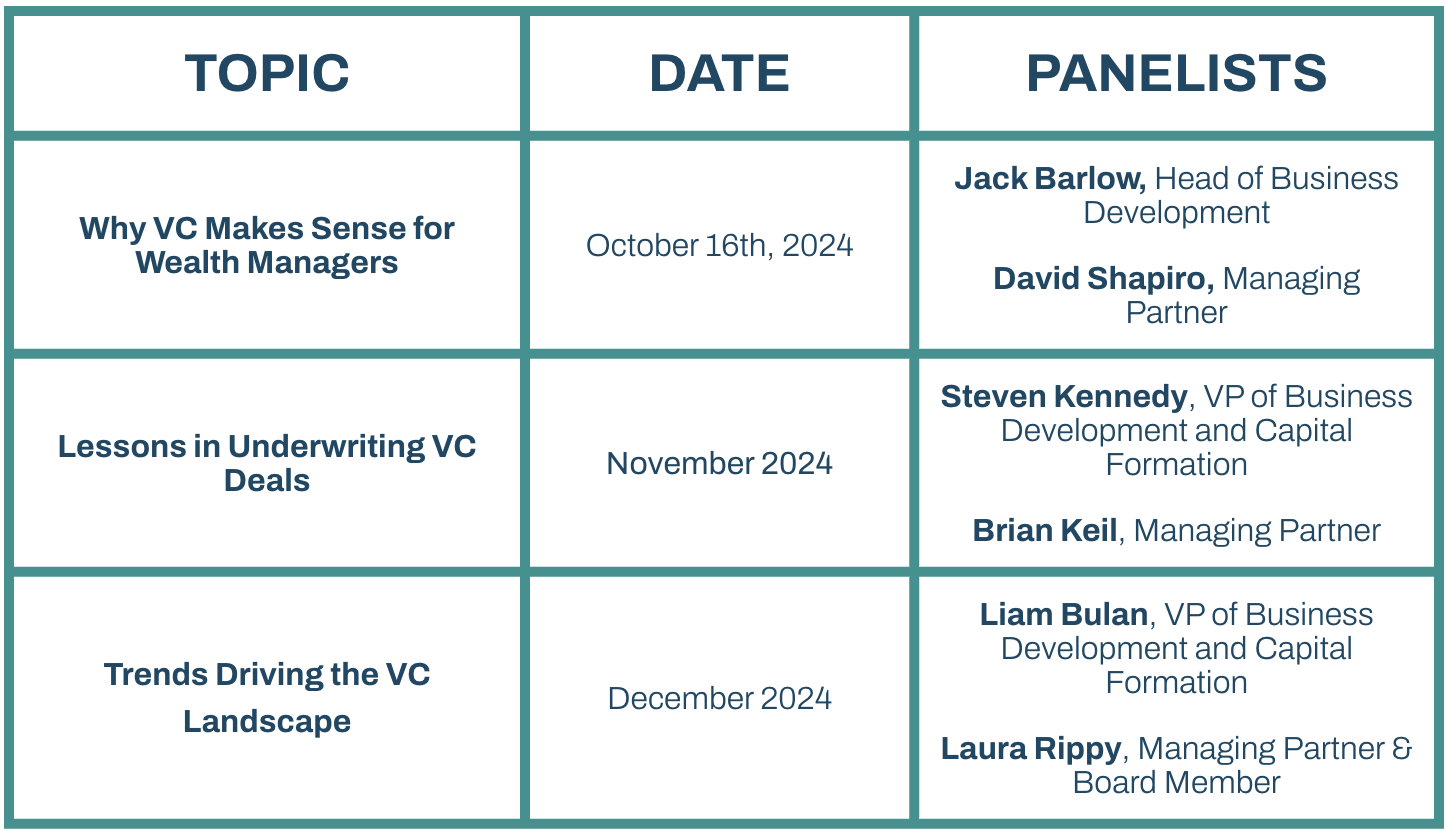

Alumni Ventures’ Fall RIA Educational Series will provide wealth managers with foundational, current knowledge on venture capital. Each webinar will build upon prior sessions—covering the following topics:

Contact [email protected] for additional information. To see additional risk factors and investment considerations, visit av-funds.com/disclosures.

About your presenters

Chief Business Development Officer

Jack has over 20y experience in the asset management industry mainly oriented around the development and distribution of traditional private and open-ended alternative investment solutions to the wealth management community. He has worked across all major financial intermediary channels, including global private banks, national brokerages, registered investment advisers, and independent broker/dealers. Most recently, he helped lead BlackRock’s effort to bring its private market franchise to wealth including the launch of four evergreen solutions covering private credit, private equity, and hedge fund strategies. Prior to BlackRock, Jack was one of the original members of Blackstone’s Private Wealth Solutions team where he co-led the national account effort. Earlier in his career, he held corporate positions with Bank of America’s Alternative Investment Group, FleetBoston Financial, and management consulting. Jack has an Economics degree from Hobart College and an MBA from University of Chicago’s Booth School of Business.

David has over 25 years of experience as an investor, adviser, and board member, with expertise across early- and late-stage venture capital. Before joining Blue Ivy, David was Senior VP of Corporate Development and Business Development for DataXu, a marketer-aligned data and analytics company. Prior to his time at DataXu, he was a Director with the global venture and private equity firm 3i, including board directorships with ten companies. He also worked in the private equity group at GE Asset Management, where he specialized in late-stage venture and growth capital opportunities. David received his BA in History from Yale in 1991 and an MBA from the Tuck School of Business at Dartmouth in 2000.