Certa: Optimizing Third-Party Lifecycle Workflows

An end-to-end workflow orchestration platform for third-party risk management

Third-party vendors (suppliers, partners, customers, etc.) are crucial to a company’s growth and success. Yet, onboarding these vendors is among the most time-consuming, opaque, and manual processes within an enterprise. Companies face a wide spectrum of risks across several domains (legal, privacy, procurement, compliance, etc.) and need to coordinate with multiple stakeholder groups to ensure that they’re sufficiently mitigating each one. Growing data security concerns, privacy regulations, evolving sanctions, and a heightened emphasis on ESG only add further complexity and burden to the overall process. As a result of these bottlenecks, onboarding new vendors can take mid to large enterprises over 90 days.

The increase in the number of third parties that enterprises rely on has made the need for integrated risk management a top corporate initiative. Large companies often have hundreds of thousands of suppliers across the globe — Walmart, for example, has over 100,000 — each of which needs to be thoroughly vetted to be safely onboarded. As a result, many businesses are now seeking out TPRM solutions — a market expected to reach $8 billion by 2025. However, even with this high demand, there are yet to be any clear category leaders in the space.

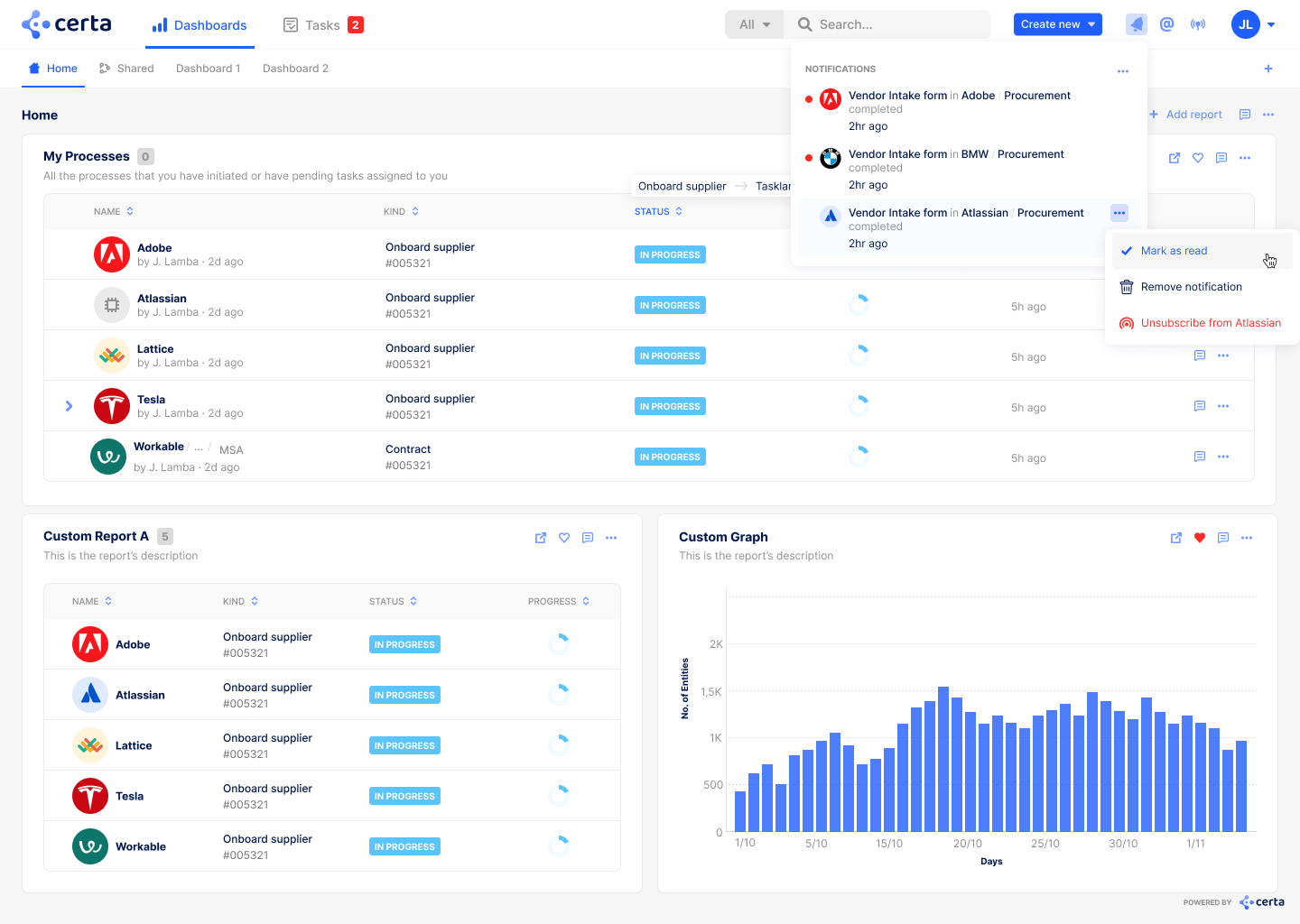

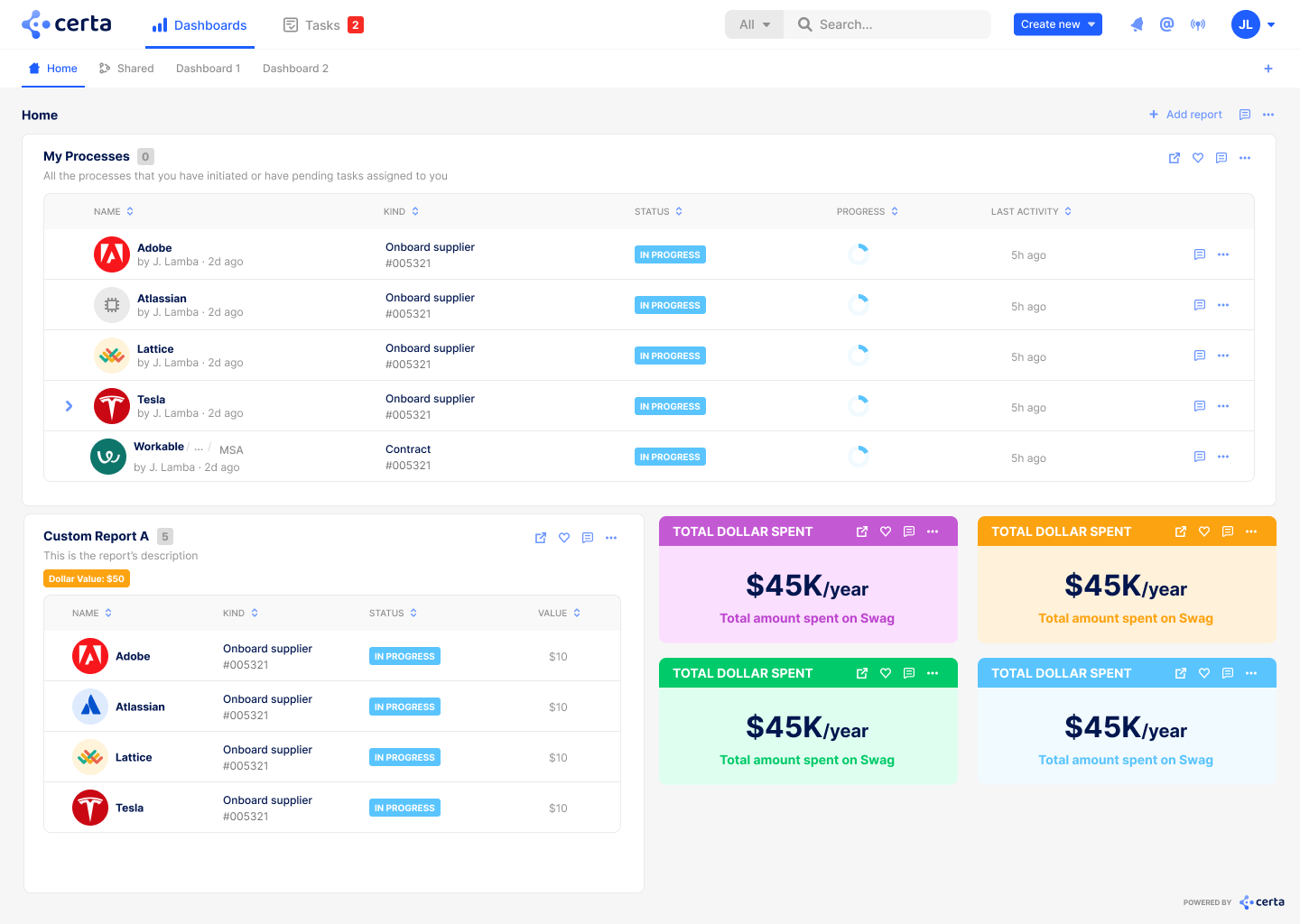

Enter Alumni Ventures portfolio company Certa, a no-code workflow management platform that helps organizations optimize third-party lifecycle processes. The company’s platform allows users to monitor B2B lifecycle management — from onboarding, contracting, due diligence, risk mitigation, and monitoring of vendor and other third-party relationships.

Addressing a Growing Need

While there are many players in the third-party risk management landscape, few offer an end-to-end orchestration platform. Currently, enterprises rely on stacking individual TPRM solutions that focus only on a single risk domain, leading to incomplete risk management and onboarding friction for new vendors.

However, Certa offers a TPRM platform (structured as a SaaS model) that can streamline and automate each aspect of working with third parties:

- End-to-end third-party management: While most companies focus on siloed solutions, Certa enables companies to handle vendor lifecycle management for onboarding, risk management, monitoring, and contract management on the same platform.

- Co-developed with leading enterprises: Current TPRM solutions are built on legacy tech and lack flexibility. Certa was co-developed with Uber and McKinsey to meet enterprise-specific demands such as intuitive UI and UX, fully customizable and automated workflows, AI functionality, and global presence with multilingual capabilities.

- Low/no-code functionality: The low-code functionality of Certa allows enterprises to implement the software without using excess resources on IT teams and build additional customizable features to fit a client-specific solution.

Certa’s highly sticky platform automates ~80% of the vendor decision-making process, reducing onboarding time from months to days. The company currently has several well-known enterprise clients — including a Ridesharing Giant, Top 3 Global Retailer, Top Data Storage Company, Top Grocery Delivery Company, Top 3 Payment Network, and the #1 Online Craft Marketplace (among several others) — using its system across various business units with no customer churn. In the long term, Certa is looking to expand into adjacent products, such as vendor marketplaces and recommendations, to capture the SMB market.

How We Are Involved

Chestnut Street Ventures (for the Penn community), Castor Ventures (for the MIT community), and Green D Ventures (for the Dartmouth community) deployed capital in Certa’s $15 million Series A. The round was led by Point72 Ventures.

Want to learn more?

View all our available funds and secure data rooms, or schedule an intro call.

New to AV?

Sign up and access exclusive venture content.

Contact [email protected] for additional information. To see additional risk factors and investment considerations, visit av-funds.com/disclosures.