Webinar

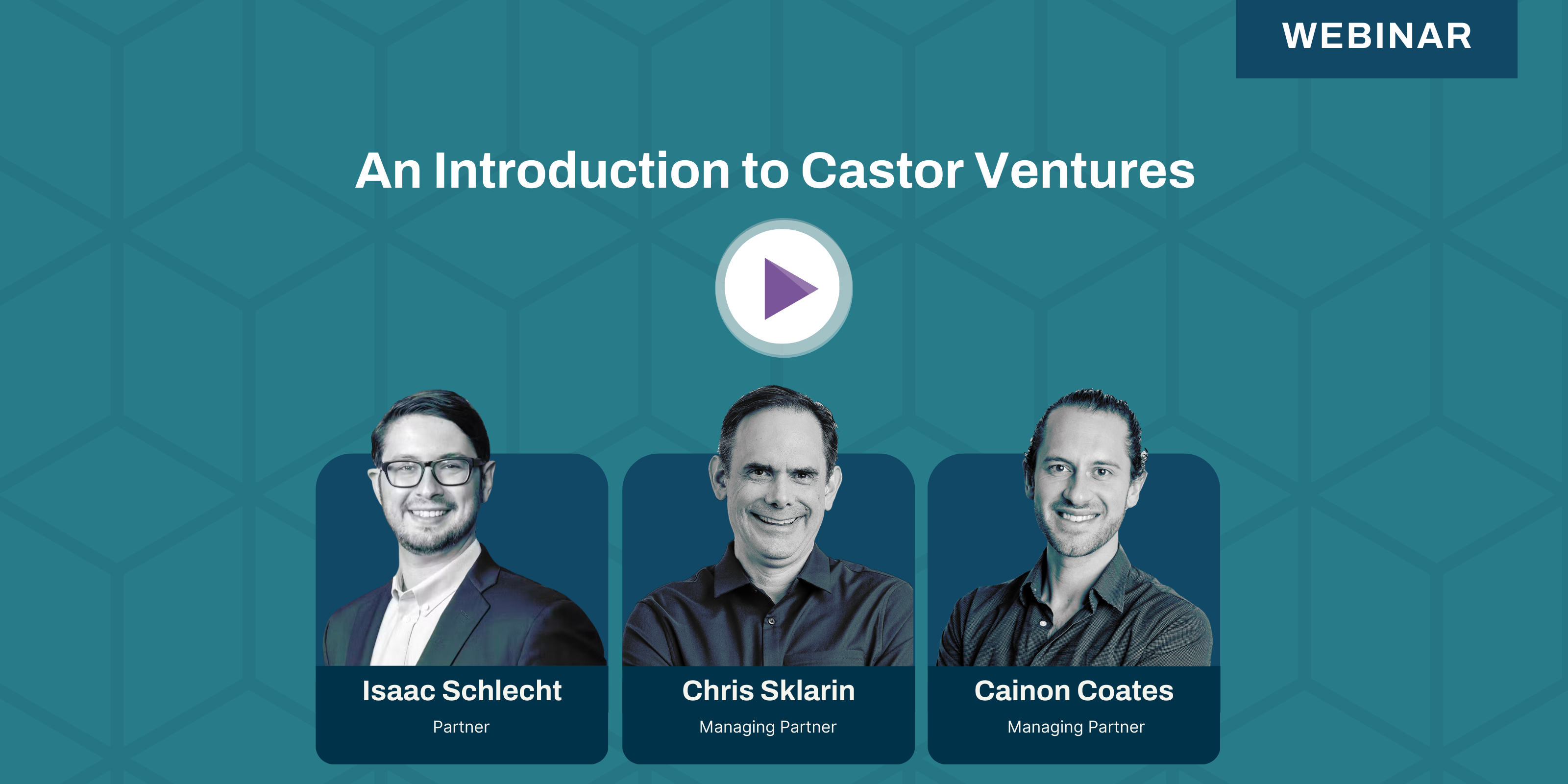

An Introduction to Castor Ventures

Watch this on-demand presentation to learn about Castor Ventures, Alumni Ventures’ MIT-focused venture capital fund, and meet the investment team responsible for building the portfolio.

This is an excellent opportunity to meet the team and hear about their approach to investing in private-stage companies. This presentation was led by Managing Partners Chris Sklarin and Cainon Coates, as well as, Senior Principal Isaac Schlecht.

During this session, we discussed:

- HomeThe goal and structure of the fund

- HomeThe team and management behind the fund

- HomeThe Castor Ventures and Alumni Ventures approach to investing

- HomeExamples of current portfolio companies

- HomeThe benefits of investing in venture capital

Note: You must be accredited to invest in venture capital. Important disclosure information can be found at av-funds.com/disclosures.

About your presenters

Chris has 30+ years of experience in venture capital, product development, and sales engineering. As an investor, he has deployed over $100 million into companies across all stages, from seed to growth/venture. At AV, Chris has built Castor Ventures from Fund 2 – 7 to over 150 portfolio companies. Prior to Castor, Chris was a Vice President at Edison Partners, where he focused on Enterprise 2.0 and mobile investments. Previously, Chris served as Director of Business Development at a biomedical venture accelerator and at an early-stage venture firm. Earlier in his investing career, as part of JumpStart, a nationally recognized venture development organization, Chris sourced and executed seed-stage investments. Chris received his SB in Electrical Engineering from MIT in 1988 and his MBA from the Haas School of Business at the University of California, Berkeley.

For the past 15 years, Cainon has worked with startups as an entrepreneur, advisor, and investor. Previously, he helped co-found several companies, including: Viafy (acquired by Constellation Software [TSX:CSU]), Human Design Medical (merged with Breas Medical of General Electric [NYSE:GE]), Triangle Research Labs (acquired by Lonza [SIX:LONN]), Revive Pharmaceuticals (acquired by Concordia Healthcare [TOR:CRX]), and University Laundry (acquired by a national operator, then Procter & Gamble’s Tide [NYSE: PG]). Cainon also worked at PBM Capital (a $500M healthcare-focused VC firm), Boston Consulting Group (BCG), Goldman Sachs, and NASA. He has an MBA from MIT’s Sloan School of Management and a BS from the University of Virginia in Systems and Information Engineering.

Isaac is an experienced investor and analyst, leading research, sourcing deals, and coordinating diligence for venture and growth equity firms. Prior to joining Castor, he was an Investment Consultant to Tiger Global Management and founded Buttonwood Gaming, developing a digital economic simulation game with collaborators at MIT and worldwide. Earlier, Isaac served as Senior Analyst, Business and Research at Catalyst Investors, and an Associate at Samson Capital Advisors (now Fiera Capital). Isaac has an MBA from MIT’s Sloan School of Management, an AB from Brown University in Economics and Political Theory, and is a Chartered Financial Analyst (CFA) charterholder.