Webinar

Arbor Street Ventures Last Call

The deadline for Arbor Street Ventures Fund 3 is around the corner and the team is beginning to deploy capital and build the portfolio. Join us for this on-demand presentation as Managing Partner David Beazley gives an overview of Arbor Street Ventures Fund 3 and explains how the team constructs a fully diversified venture portfolio.

See video policy below.

Post Webinar Summary

David Beazley, Managing Partner, led the final webinar of the year for Alumni Ventures, highlighting the upcoming last call for investments. The session covered previous fund successes, including Mirror Lake and Arbor Street funds, and previewed promising opportunities for their next rounds. Mike Peri discussed Alumni Ventures’ growth, now recognized as a top 20 venture investor, outperforming other firms in performance. They emphasized their network’s role in sourcing high-quality deals and their focus on building diversified portfolios. The discussion included notable investments like Bezel, Bionaut Labs, and Generate Bio, showcasing innovative technologies and market potential. They concluded with an overview of their investment process, syndication opportunities, and a call to action for the upcoming fund close.

This live presentation about Arbor Street Ventures Fund 3 is open to all alumni and friends of the University of Michigan. Arbor Street Ventures is Alumni Ventures’ Michigan-focused venture capital fund.

During the session, we will discuss:

- HomeThe goal and structure of the fund

- HomeBenefits of diversifying into venture capital

- HomeMinimum requirements needed to invest in the fund

- HomeThere will be time for open questions and discussion during the call

About Alumni Ventures

Note: You must be accredited to invest in venture capital. Important disclosure information can be found at av-funds.com/disclosures.

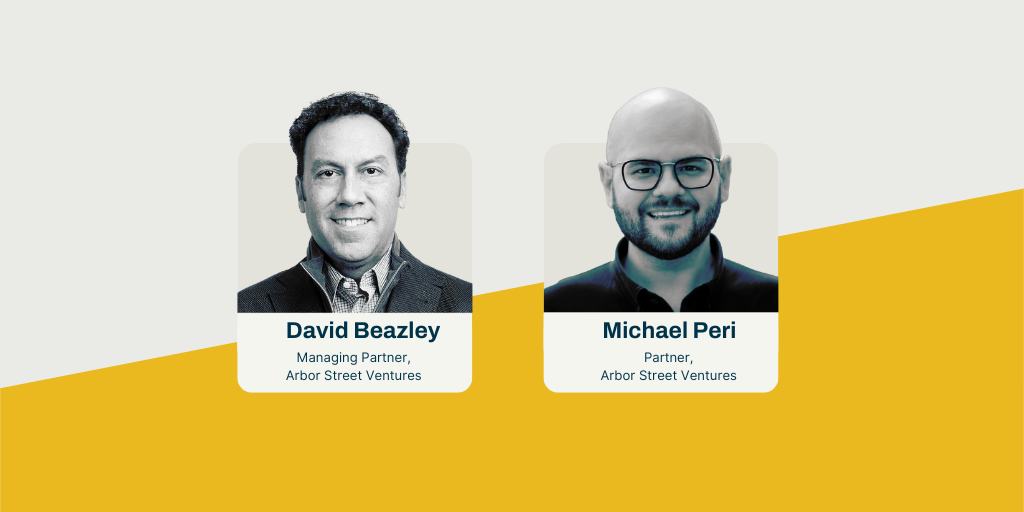

About your presenters

David has played a leading role in many aspects of the VC investment cycle: structuring transactions as a fundless sponsor, improving operations as a consultant, leading management teams as a CEO, evaluating opportunities as an investor and advisor, and selling companies as a licensed business broker. Previously, he founded Synergy Financial, a private capital and consulting firm for entrepreneurs, PE professionals, and family offices. He started his investment career as a professional advisor managing millions in assets. David has undergraduate and graduate degrees from Northwestern and played for the two-time Big Ten Championship Northwestern Wildcats Football Team. He serves on the NUvention and Kellogg Entrepreneurial Center Advisory Boards.

Partner, Arbor Street Ventures

Mike, an accomplished venture capitalist and operator with over a decade of industry experience, brings a wealth of expertise to Alumni Ventures. Before joining AV as a Partner, he held a Lead Director role at CVS Health Ventures, where he focused on investments in early and growth-stage digital health companies and played a key role in shaping the firm’s portfolio management strategy. Prior to this, Mike served as a Partner at Distributed Ventures, an early-stage fund with a strong thematic emphasis on digital health, insuretech, and fintech sectors. His journey in the industry began with leadership in product and analytics at Yaro Health, a venture-incubated company that achieved a successful acquisition. Throughout his career, Mike has assumed pivotal roles in strategy, early-stage startups, and data science, shaping his comprehensive understanding of the venture landscape. Mike holds a Masters of Science in Applied Data Science from the University of Chicago, along with graduate and undergraduate degrees from DePaul University and the University of Iowa, respectively.