A VC's Playbook: How Time Arbitrage Is an Investing Superpower

The best investments share one key trait: patience. The longer your time horizon, the fewer competitors — and potentially the greater the rewards.

Long-Term Thinking in a Short-Term World

We live in an era of instant gratification. From one-click shopping to 280-character tweets, technology has conditioned us to expect immediacy. Dopamine-driven apps and 24/7 news cycles keep us stimulated — and impatient.

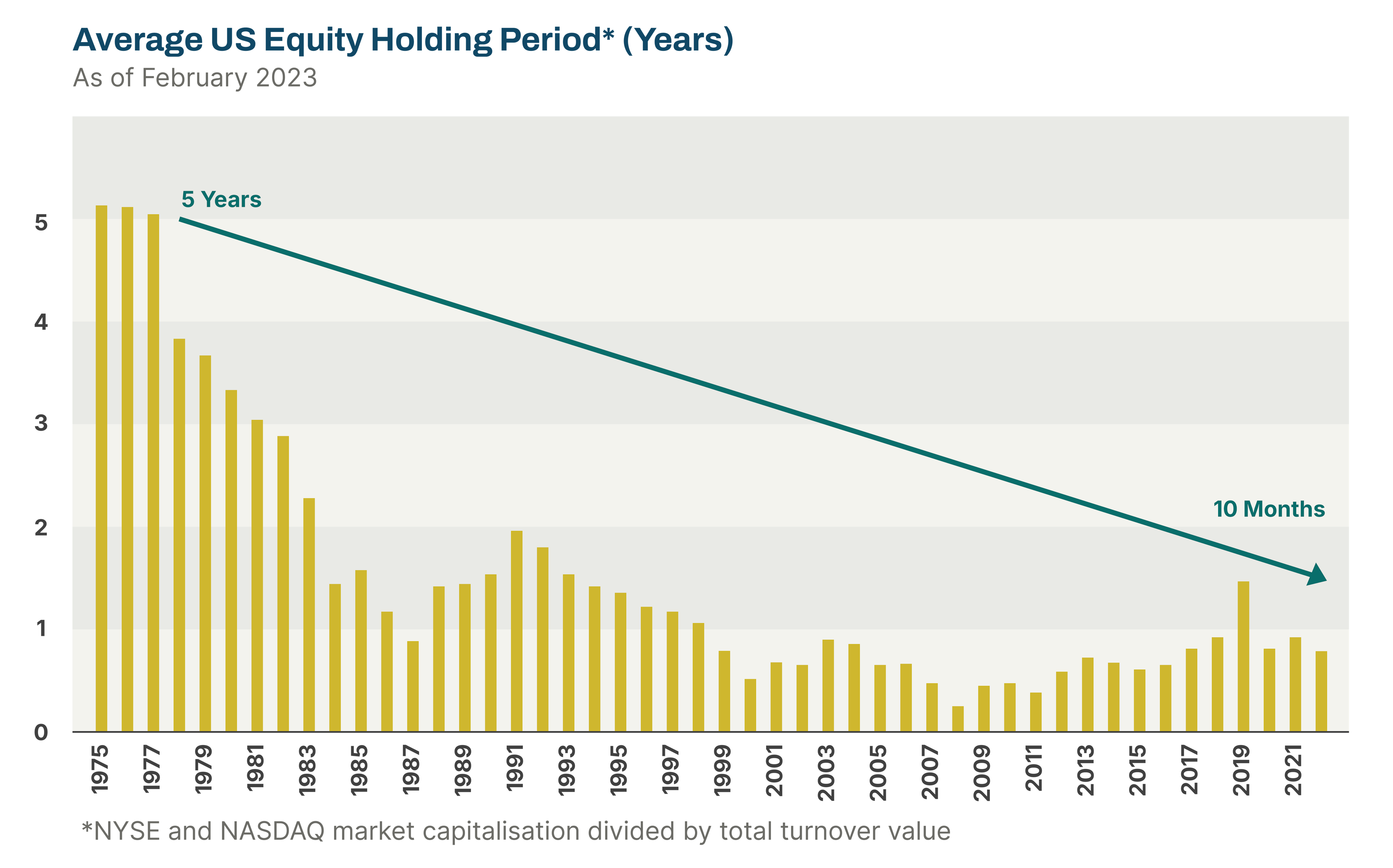

Nowhere is this more evident than in investing. In the 1960s, the average stock was held for eight years. Today, it’s traded after just a few months. Investors fixate on quarterly reports, stock tickers, and breaking news, often at the expense of long-term strategy.

This short-term mindset creates market inefficiencies that patient investors can exploit. Present bias, loss aversion, herd mentality, and short attention spans lead to mispriced opportunities, where long-term investors can earn outsized returns from compounding and illiquidity premiums. They buy what the short-sighted are selling, and hold when others fold.

SOURCE: Ben Carlson, “Buy & Hold is Dead, Long Live Buy & Hold,” A Wealth of Common Sense, February 17 2023.

What Is Time Arbitrage?

In investing, time arbitrage is the practice of maintaining a longer-term perspective than the average investor. It means seeing value where others are too focused on short-term gains to notice. As Warren Buffett famously said: “The stock market is a device for transferring money from the impatient to the patient.”

Venture capitalists (VCs) embody this approach. While much of Wall Street obsesses over quarterly earnings, VCs spend their time evaluating companies that won’t mature for years. They extend their time horizon, capitalizing on the gap between society’s addiction to short-term feedback loops and the substantial rewards that come to those who think in five-year chunks — or even decades.

In a world increasingly obsessed with the present, time arbitrage is a superpower. This blog explores how venture capitalists leverage behavioral economics to make money by doing what others won’t: waiting.

1. The Science of Time Preference

Present bias — the tendency to favor immediate rewards over significantly larger future ones — is a fundamental human instinct.

A classic experiment illustrates this. Given the choice between $100 today or $120 in a week, most people take the instant cash, even though waiting just seven days would yield a far better return. However, when asked to choose between $100 in a year or $120 in a year and a week, people suddenly become willing to wait for the extra $20.

In other words, we are highly impatient in the short term but much more rational when the delay feels distant. Our brains exponentially undervalue long-term outcomes, making it difficult to prioritize future rewards over instant gratification.

By overcoming present bias and valuing the future more appropriately, VCs position themselves to reap the outsized rewards of long-term compounding growth that others pass up. VC is a “get rich slow” proposition.

2. The Trap of Acting Too Quickly

Modern technology and media have wired investors for short-term thinking. We are bombarded with real-time updates, and this relentless stream trains our brains to expect instant feedback, creating a fear of missing out (FOMO) — the urge to act quickly before it’s “too late.”

As a result, investors often overreact to short-term events. A single bad earnings headline can send a stock into a tailspin, even when the company’s long-term prospects remain intact. Too much weight is placed on immediate factors, while the bigger picture is ignored.

CEOs and investors alike feel the pressure to deliver results this quarter, fearing their constituents will pull support if they don’t. In short, everyone is chasing the next click, the next quarter, the next quick buck.

The market for quick gains is highly competitive and picked over, while the market for long-term value remains less crowded.

Cognitive Inefficiencies Ripe for Arbitrage

This frenetic short-term focus creates market mispricings — opportunities that patient, strategic investors can exploit. As legendary investor Bill Miller observed: “When everyone is concerned with minute-to-minute performance, the real inefficiencies are found beyond the 12-month mark.”

In other words, the market for quick gains is highly competitive and picked over, while the market for long-term value remains less crowded.

Smart VCs and investors step into this gap. They tune out daily noise and look for opportunities that may take years to materialize. In doing so, they act as arbitrageurs of time — buying what short-term traders sell cheap.

Case Study 1: Rigetti – Investing in Quantum’s Long-Term Potential

Alumni Ventures’ investment in Rigetti, a full-stack quantum computing company, was driven by its strong technical moat and key partnerships, including AWS. However, as commercial momentum slowed, Rigetti’s stock plunged to an all-time low in May 2023.

While many investors lost confidence, AV remained committed to Rigetti’s long-term potential, particularly its modular quantum chips and pioneering gate-based approach. When Rigetti rebounded, Alumni Ventures seized the opportunity, selling 87% of its total position in Q4 2024, delivering a strong return to investors.

This case highlights the importance of staying the course in deep-tech investments despite short-term volatility.

SOURCE: Muslim Farooque, “Rigetti Computing Soars 41% Tuesday: Quantum Milestones and Partnerships Electrify the Market,” GuruFocus.com, December 10 2024.

Not necessarily indicative of outcomes experienced by AV funds or investors. Past performance does not guarantee future results.

3. VCs as Structural Time Arbitrageurs

Long-Term Capital, Outsized Rewards

Venture capitalists are structural time arbitrageurs by design. We raise funds with the understanding that capital could be locked up for 10+ years — a timeframe unthinkable to most traders and public market investors. This long-term capital base allows VCs to invest in opportunities that require years to mature.

The payoff for this patience can be extraordinary. Early investors in companies like Amazon and Uber had to wait years for profitability or an IPO, but those who held on ultimately earned hundreds or even thousands of times their initial investment. Although these are outlier examples that went public before Alumni Ventures was founded, one great investment can be life-changing.

Such is the power of underappreciated compounding. A startup growing revenue at 50% per year may seem modest at first, but over a decade, that’s transformative growth. By staying the course, VCs capture the exponential upside that quarterly focused investors miss.

In fact, the inability to sell on impulse forces compounding and patience — one of the key reasons venture capital has historically delivered strong returns.

Venture capitalists are structural time arbitrageurs by design. We raise funds with the understanding that capital could be locked up for 10+ years — a timeframe unthinkable to most traders and public market investors. This long-term capital base allows VCs to invest in opportunities that require years to mature.

Illiquidity Premium and Strategic Patience

Because VC investments are illiquid — you can’t just sell a startup stake on the open market — investors demand higher returns for this inconvenience. Historically, private equity and venture funds have earned an illiquidity premium of 3–5% per year above public market returns.

In simple terms, patient money earns extra returns.

This is time arbitrage in action: VCs earn more because they are willing to lock up capital while others demand liquidity.

Ironically, illiquidity can be an advantage — it prevents emotional selling when the news isn’t promising and reinforces strategic patience. As Amazon founder Jeff Bezos put it: “If you can extend your time horizon to seven years, you’ll compete with only a fraction of investors, since so few are willing to wait that long.”

SOURCE: Bob Zider, “How Venture Capital Works,” Harvard Business Review, December 1998.

4. Loss Aversion & Fear of Uncertainty

Humans are hardwired to avoid loss at all costs. Psychologists Daniel Kahneman and Amos Tversky quantified this as loss aversion — the idea that losing $100 feels about twice as painful as the pleasure gained from earning $100.

This bias leads investors to be overly cautious and averse to uncertainty. The possibility of failure looms larger than the probability of success, making many mainstream investors overvalue risk. They demand unrealistically high returns before considering a risky venture — often much higher than a rational assessment would suggest. As a result, they may pass on a startup with 5x potential simply because there’s a 30% chance of failure, even if the expected value remains highly positive.

Venture capital operates under a power law dynamic, where a handful of winners can more than compensate for losses. In VC, the downside is capped at 1x your investment, but the upside can be 20x, 50x, or even 1,000x. The key is having a large enough portfolio to capture the outliers.

Unlike traditional investors, VCs understand that uncertainty and opportunity go hand in hand. For example, in the early stages of transformative technologies — whether AI, nuclear energy, or space tech — the high uncertainty level deters many investors. Yet when risk is perceived as high, valuations are often artificially low. VCs capitalize on this by leaning into uncertainty, securing favorable entry prices and terms on deals that others pass up.

VCs also manage loss aversion through a portfolio strategy, accepting that 7 out of 10 startups may fail while knowing that one breakout success can offset those losses many times over. This probabilistic mindset allows them to overcome the fear of loss that might paralyze other investors.

That’s one reason AV encourages investors to build a portfolio of at least 100-200 companies over 3-6 years, investing alongside strong lead investors where the biggest opportunities tend to emerge. It’s all about mathematics — maximizing the probability of making transformative investments.

5. The Power of Crazy Thinking

All truth passes through three stages. First, it is ridiculed. Second, it is violently opposed. Third, it is accepted as being self-evident.”

— Arthur Schopenhauer

Financial markets often resemble herds of sheep — chasing the latest trend or fleeing at the first sign of trouble. This herd mentality is fueled by social proof (“everyone else is buying it, so it must be good”) and regret avoidance (“I don’t want to be the only one missing out”).

But herding creates inefficiencies — popular assets become overvalued bubbles, while overlooked opportunities often hold the greatest potential. Smart VCs practice contrarian thinking, deliberately seeking value where others are skeptical or indifferent. As Warren Buffett famously put it: “Be fearful when others are greedy and greedy when others are fearful.”

A vivid example of herd behavior was the mid-2010s “sharing economy” gold rush. As Uber and Airbnb skyrocketed in valuation, virtually every VC fund chased the “next Uber of X.” The number of venture-funded sharing startups jumped 10x between 2007 and 2016, leading to spectacular busts like WeWork (once valued at $47B, later bankrupt) and scooter company Bird (from a $2.5B IPO to penny stock).

The herd paid the price.

The best VCs avoid hype cycles and stick with winners when others panic. Our own firm has raised a Blockchain Fund every year for the past six years, through booms and busts, ignoring short-term noise in favor of long-term fundamentals.

History shows that outsized returns often come from going against the grain:

- HomeInvesting during downturns when capital is scarce.

- HomeBacking unconventional founders dismissed by their peers.

- HomeHolding onto great companies when others panic and sell.

- HomeBy resisting crowd psychology, contrarian investors buy low (when others are fearful) and sell high (when the masses finally catch on).

In venture, crazy bets or stubborn can deliver the biggest wins when right. This is yet another way VCs exploit behavioral biases — turning herd mentality into opportunity.

6. Airbnb’s Early Rejection: A Lesson in Time Arbitrage

Few stories illustrate time arbitrage better than Airbnb’s origin. In 2008, Airbnb’s founders were desperate for funding, pitching their home-sharing idea to seven prominent investors in hopes of raising $150,000 for 10% of the company.

All seven passed. Why? Their responses reflect common behavioral biases. One dismissed the idea because “the market opportunity didn’t seem large enough.” At the time, almost no one was renting rooms to strangers — it seemed niche, even absurd. Their present bias was clear: they anchored to the existing market size and failed to imagine what it could become. Another rejected it because it was “not in our focus area,” sticking rigidly to familiar territory. In hindsight, these investors were blinded by status quo thinking and fear of the unproven.

Airbnb went on to create an entirely new industry and is now worth around $100 billion. Had any of these investors written that $150K check, they would be worth billions today.

Venture capital is as much about the deals you pass on as the ones you close. Great ideas are often overlooked at first.

This case highlights how behavioral biases — anchoring to the present, narrow framing, and fear of uncertainty — led even smart investors to undervalue a revolutionary idea. The VCs who overcame these biases can earn a life-changing arbitrage on time and insight.

Venture capital is as much about the deals you pass on as the ones you close. Bessemer Venture Partners openly acknowledges this through its “Anti-Portfolio” —a candid collection of major investment opportunities they declined, which later became wildly successful. Their list includes Airnb, as well as Apple, Google, Facebook, and Tesla. By sharing these stories, Bessemer underscores an essential truth of venture capital: Great ideas are often overlooked at first. Investing requires humility, adaptability, and continuous learning.

Explore Bessemer’s Anti-Portfolio here.

Case Study 2: Sleeper – Playing the Long Game in Fantasy Sports

AV first connected with Sleeper in 2014, recognizing its potential when fantasy sports was still a niche market. Originally launched as “Sleeperbot,” a fantasy football chat app, it rebranded as “Sleeper” in 2017 with the launch of its full fantasy league platform, differentiating itself through social-driven features like in-app chat and draft rooms.

AV invested in Sleeper’s $1M pre-seed round in 2015, confident in the company’s vision despite market uncertainty about the space. Over time, Sleeper expanded beyond fantasy football, adding basketball in 2020 and evolving into a full-fledged sports super app. By 2024, it had grown its user base 200x, hit #1 in the App Store’s Sports category multiple times, and secured funding from top investors like General Catalyst and Andreessen Horowitz.

Sleeper’s journey underscores the power of patient investing in consumer platforms with strong network effects.

7. The Dopamine Economy & Its Impact on Investor Behavior

A Microsoft study found that between 2000 and 2015, the average human attention span shrank from 12 seconds to just 8 seconds — shorter than a goldfish’s 9-second span.

Dopamine, often called the “feel-good” hormone, plays a major role in our pursuit of pleasure — whether it’s the high from a shopping spree or a slice of pizza. We now live in the “dopamine economy”—a world where digital products hijack our brain’s reward system. Each ping, like, and notification delivers a small dopamine hit, conditioning us to crave instant gratification. Over time, this has eroded our ability to focus and sustaining long-term focus has never been harder.

For investors, this manifests as itchy trigger fingers — constantly checking portfolios, reacting to every fluctuation, and chasing the thrill of action. With the rise of commission-free trading apps, investing has morphed into entertainment, resembling a social media feed or even sports betting. People compulsively buy and sell stocks for the same dopamine rush that fuels gambling.

As Nobel Prize-winning behavioral economist Richard Thaler observed, the boredom of holding index funds during the pandemic pushed many into day trading — not because it was rational, but because it felt more exciting.

Modern digital life encourages risk-taking for quick rewards but undermines the slow, deliberate thinking that long-term investing requires. If you’re accustomed to instant gratification, the gradual progress of a 10-year investment can feel agonizing.

Instant gratification and noise from the dopamine economy can make it hard to stick to long-term investing plans and patient waiting.

Worse, the dopamine economy bombards us with noise, making it harder to distinguish signal from distraction. Investors may react to X rumors or Reddit hype, following the crowd instead of sticking to fundamentals. This increases short-term trading and heightens volatility.

By necessity, VCs step outside this constant feedback loop. Their job isn’t to chase trends — it’s to envision the world 5, 10, or 20 years from now. For VCs and disciplined investors, resisting the dopamine economy means adopting new habits:

- HomeReviewing investments quarterly, not hourly.

- HomeCelebrating long-term milestones instead of daily fluctuations.

- HomeLeveraging illiquidity as an advantage — lock-ups prevent impulsive trading and help shut off the “dopamine tap.”

Time arbitrage has always been about looking further ahead than others, and in the dopamine age, doing so is both harder and more rewarding than ever.

8. Time Arbitrage: Essential Strategies for Smart Investors

Anyone can use the principles of time arbitrage to become a better, more disciplined investor. Here are some practical ways to apply them.

Stretch Your Time Horizon: Think in years and decades, not days or months. Before making an investment, ask yourself: Would I be comfortable holding this for 5–10 years? If the answer is yes, you’re already ahead of the short-term herd.

Tune Out Short-Term Noise: Information overload can hurt more than help. Delete that stock app from your phone. Check your portfolio quarterly, not daily. Focus on long-term fundamentals (like multi-year earnings growth), not sensational headlines. A temporary price dip doesn’t matter if the long-term thesis is intact. It might even be a buying opportunity.

Embrace Contrarian Opportunities: When fear dominates the market, look for time-arbitrage openings. Negativity driven by emotion, not fundamentals, can be an opportunity. Buy when others won’t — and be cautious when euphoria sets in. Don’t follow the crowd, follow the data.

Manage Your Behavioral Biases: Be aware of your psychological tendencies. If you panic at losses, remind yourself of loss aversion bias — volatility is the price for higher returns. If you sell winners too early, reframe holding as earning even more by waiting. Some investors set minimum holding periods or structured selling rules to enforce discipline. Awareness is the first step.

Use Selective Illiquidity to Your Advantage: Sometimes not being able to sell easily makes you a better investor. Consider allocating part of your portfolio to illiquid, long-term investments like venture funds, private equity, or retirement accounts with withdrawal penalties. Making access slightly inconvenient — like storing login info in a safety deposit box — can help prevent impulsive decisions.

Think in Probabilities, Not Certainties: VCs accept that some investments will fail — but the winners can make up for all the losses and more. Instead of asking, “Will this succeed?”, ask “How big could this be if it works?” You can even apply a VC-style approach: Allocate a small portion of your portfolio to high-risk, high-reward ideas (“moonshots”), while keeping the rest in stable investments.

Time arbitrage has always been about looking further ahead than others, and in the dopamine age, doing so is both harder and more rewarding than ever.

Final Takeaway – The Investor Who Waits Wins

By implementing these strategies, you’ll be in a position to capitalize on others’ impatience, fear, and herd behavior — turning widespread psychological biases into opportunities. Time arbitrage isn’t just a strategy; it’s a mindset shift that rewards those who think ahead.

The message for investors is clear: embrace time arbitrage and shift the odds in your favor. In a world obsessed with the short term, patience has never been more valuable because it is so rare.

Whether you’re investing in startups, stocks, or retirement funds, the principle remains the same: extend your time horizon, stay rational amid irrationality, and capitalize on the impatience of others. Resist the dopamine-fueled impulses and the noise of the crowd. Instead, be the investor who waits for the second marshmallow — the one who understands that time is the ultimate revealer of value.

In the end, those who master patience will reap the rewards that others leave behind.

Investment returns generally increase with the degree of illiquidity, for which venture capital historically has had the best performance.”

SOURCE: “Having Patience with the Venture Capital Timeline,” Laconia, May 30 2018.

Learn More About the Foundation Fund

~20-30 investments diversified by stage, sector, geography, and lead investor. Deployed over 12-18 months.

Max Accredited Investor Limit: 249

This communication is from Alumni Ventures, a for-profit venture capital company that is not affiliated with or endorsed by any school. It is not personalized advice, and AV only provides advice to its client funds. This communication is neither an offer to sell, nor a solicitation of an offer to purchase, any security. Such offers are made only pursuant to the formal offering documents for the fund(s) concerned, and describe significant risks and other material information that should be carefully considered before investing. For additional information, please see here. Example portfolio companies are provided for illustrative purposes only and are not necessarily indicative of any AV fund or the outcomes experienced by any investor. Example portfolio companies shown are not available to future investors, except potentially in the case of follow-on investments. Venture capital investing involves substantial risk, including risk of loss of all capital invested. This communication includes forward-looking statements, generally consisting of any statement pertaining to any issue other than historical fact, including without limitation predictions, financial projections, the anticipated results of the execution of any plan or strategy, the expectation or belief of the speaker, or other events or circumstances to exist in the future. Forward-looking statements are not representations of actual fact, depend on certain assumptions that may not be realized, and are not guaranteed to occur. Any forward-looking statements included in this communication speak only as of the date of the communication. AV and its affiliates disclaim any obligation to update, amend, or alter such forward-looking statements, whether due to subsequent events, new information, or otherwise.

Alumni Ventures and its personnel provide advice only to affiliated venture capital funds. Nothing in this communication is personalized advice for any recipient.