Webinar

Alumni Ventures Blockchain Fund Presents A Deep Dive into the Metaverse Roundtable

Alumni Ventures’ Blockchain Fund is focused on the universe of opportunities opened up by blockchain technology. It’s a chance to invest in a diversified portfolio of ~20-30 promising, venture-backed companies innovating in areas like Metaverse, non-fungible tokens (NFTs), decentralized finance (DeFi), and more.

Watch our on-demand snippet of the presentation featuring AV’s CIO Anton Simunovic and AV’s Blockchain Fund Principal Sophia Zhao with guests from Mythical Games, Upland, Pixelynx, and Wedbush. The panel will take a deep dive into trends in the Metaverse, NFTs, gaming, and blockchain.

During the session, we will deep dive into:

- HomeMetaverse

- HomeNon-fungible tokens (NFTs)

- HomeGaming

- HomeBlockchain

Note: You must be accredited to invest in venture capital. Important disclosure information can be found at av-funds.com/disclosures.

Alumni Ventures’ Blockchain Fund will focus on new sectors and ventures using blockchain tech. We will provide investors in the fund with a portfolio of ~20-30 promising, venture-backed companies innovating in areas like decentralized finance (DeFi), the Metaverse, non-fungible tokens (NFTs), and more. This is an actively managed fund led by a three-person investing team, all with deep VC and blockchain experience.

To learn more, click below to review fund materials or book a call with a Senior Partner.

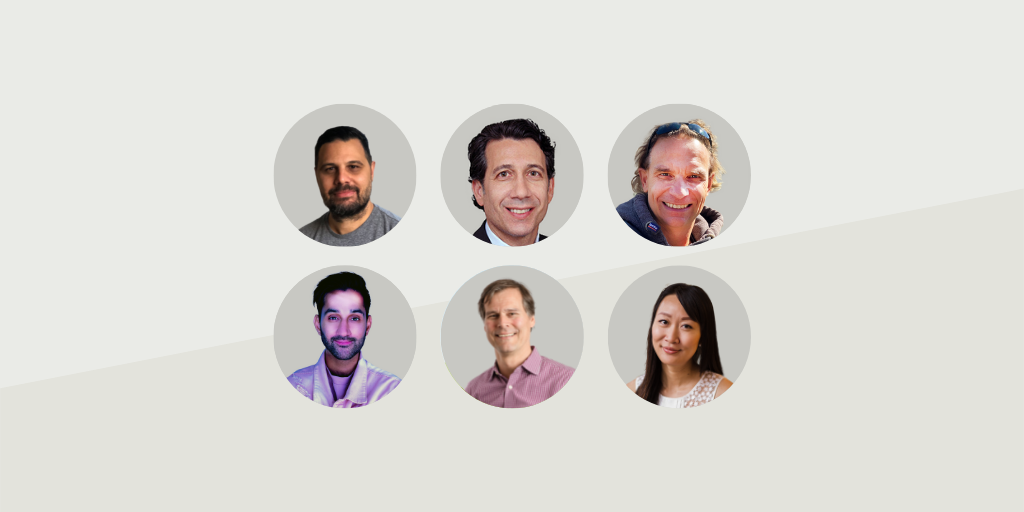

About your presenters

15 years of traditional mass market game development experience on some of the most prolific franchises in the industry: Club Penguin, Call of Duty, Skylanders, World of Warcraft. Rudy co-founded Mythical Games in 2018 to bring blockchain and NFTs to mass market games with the belief that true ownership of digital assets, verifiable scarcity, and integrated secondary markets would be the future of games.

Marc Lewis is a Co-Head and Managing Director of TMT Investment Banking at Wedbush Securities in San Francisco. He has over 25 years of focused technology investment experience, and has worked as a portfolio manager at some of the most prestigious hedge funds in the industry. Most recently, he was an investment banker focused on the software sector at BTIG. Previously, he managed TMT portfolios at Citadel, Millennium and Pequot Capital and began his portfolio management career at SAC Capital in 1998. Marc has an extensive network of public, private, and strategic software investors that he has accumulated over the years, and brings a very unique perspective to the world of investment banking. Earlier in his career, he held sales and marketing roles in the software industry, which ultimately shaped the foundation of his sector knowledge. Marc graduated from the University of Michigan and received his Bachelor of Arts degree in Organizational Behavior.

Dirk is a serial entrepreneur and an early adopter of blockchain and related technologies, based in Silicon Valley. He co-founded European and US-based companies in the FinTech and digital media spaces, including the Financial Times Deutschland and Forbatec which has been acquired by SunGard (today NYSE:FIS). Dirk mentored over 30 startups through his work at international startup accelerators in Silicon Valley and is a frequent speaker/panelist focusing on topics about the metaverse, blockchain, and platform economics. He has studied Business Administration in Frankfurt and Paris and received a Ph.D. from the European Business School in Germany where he wrote his doctoral thesis about private and state-controlled currencies.

Inder Phull is the founder and CEO at Pixelynx, a new venture that is building the music metaverse with iconic music industry partners; deadmau5 and Richie Hawtin. The company is focussed on blurring the lines between music, blockchain and gaming through a mobile application built on the Niantic Lightship ARDK as well as a desktop game that will be released in Q3 2022.

Anton has 20+ years of technology experience as a proven venture capital investor, entrepreneur, and operating executive in companies ranging in size from startup to Fortune 10. Most recently, he founded and led Vener8 Technologies, a technology commercialization company he started with GE. Previously, Anton led the Software and Internet Infrastructure Group at GE Equity, where he directly invested $72 million in 10 companies generating more than $500 million of realized gains. Anton has substantial international experience in Canada, China, Europe, and Israel, and has served on the board of directors of more than 20 private and public companies. Anton has a BSc Engineering from Queen’s University in Canada and an MBA from Harvard Business School.

Sophia dove into the exciting world of Crypto in 2017 and started her crypto career with Galaxy Digital’s Advisory team, supporting a portfolio of blockchain startup clients with investor relations and Initial Coin Offering (ICO) initiatives . She continued building her crypto deal flow and book of investor contacts during her tenure at Huobi US and Crypto.com’s exchange, working with institutional clients such as crypto hedge funds, high frequency traders on market-making, and volume trading initiatives, covering the Americas, EU and Latam regions.

Sophia is actively plugged into different protocol ecosystems and accelerators. She judges ETHGlobal and Solana’s hackathons, mentors at Algorand’s Accelerator and Berkeley’s Blockchain Xcelerator, and governs Harmoney’s Incubator DAO as a governor.

Sophia comes from a background of business development and corporate development, having worked with CXOs and Entrepreneurs on their financing and business strategies. She holds a BBA from Simon Fraser University, an MBA from University of British Columbia, and an MAM from Yale School of Management.