5 Questions with Persefoni

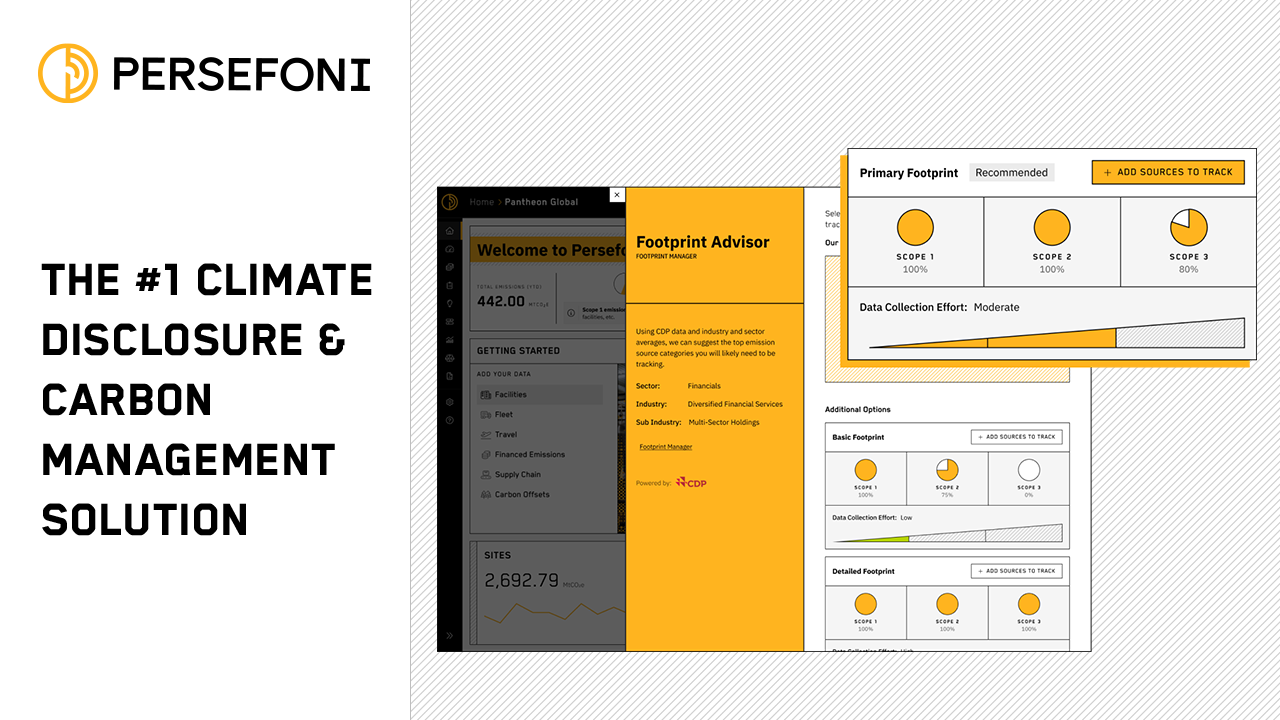

Persefoni’s SaaS platform provides organizations with a fully transparent and auditable picture of their carbon footprint

Persefoni has developed a SaaS platform to help organizations measure, analyze, plan, forecast, and report on their carbon footprint. The company leverages AI to provide businesses, financial institutions, and governmental agencies with a fully transparent and auditable picture of their carbon footprint, simplifying sustainability reports and regulatory disclosures.

Alumni Ventures co-invested with Prelude Ventures and TPG’s The Rise Fund in Persefoni’s $101 million Series B — the largest venture round to date raised by a SaaS climate tech startup. The round was part of a significant influx of capital into climate-focused startups, which raised over $43 billion in 2021.

We were impressed by Persefoni’s comprehensive, AI-driven solution for enterprises at a time where regulations and corporate strategy around lowering emissions are converging. Our relationship with the company demonstrates our ability to connect with innovative, impactful startups that have significant growth potential.

See below for an interview with CEO and Co-Founder Kentaro Kawamori to learn about the huge opportunity in climate tech solutions and how Persefoni is developing an ERP framework for carbon footprint management.

Kentaro Kawamori

CEO & Co-Founder, PersefoniKentaro Kawamori was the youngest Chief Digital Officer ever at a Fortune 500 energy company. His career has focused on the software space and includes time spent as a Cloud Strategy Consultant at Accenture, and a Venture Partner focused on early-stage SaaS companies. Kentaro is also a Co-Founder and Board Director at Umbrage. In 2020, Kentaro was recognized by Forbes on its 30 Under 30 list.

What problem or opportunity is Persefoni addressing?

In 2017, I was working as the Chief Digital Officer at Chesapeake Energy. Large institutional investors like BlackRock and Fidelity started asking companies like us for climate disclosures, but nobody knew what that meant at the time. We realized that calculating our carbon footprint was a massive data challenge. There were no enterprise-grade, cloud-based tools available to us. The process was stuck in a world of spreadsheets and consultants collecting data and then making the calculations manually.

That was the proverbial light bulb moment. We launched Persefoni to help larger organizations and financial institutions turn their environmental activity data into a formatted, verifiable carbon footprint. Our platform ingests a wide range of activity data from within a company: the combustion of fuels in delivery vehicles, the consumption of energy in facilities or their supply chain, air travel, even the environmental impact of specific office supplies. We run all of that data through our calculation engine, which results in a verifiable and highly accurate carbon footprint.

What impact will climate regulations have on companies globally?

That early pressure from investors asking for climate disclosures was really just a symptom of an underlying, massive sea change. While most regulatory action isn’t global in nature, we’re seeing climate disclosure regulations happening across the board in Asia, North America, and Europe. To give you perspective on the scale, the EU is expected to finalize a carbon disclosure framework within the next 12 to 24 months that will impact upwards of 60,000 companies globally.

When I meet with potential customers about this, very few companies have a grasp of everything required to calculate a carbon footprint or create a climate disclosure. In some cases, they have absolutely no idea what regulations are about to hit them; an investor or a vendor just happened to ask them for climate disclosure data. I spend a lot of time helping them understand what data they need, where it comes from, and how we can help make that journey significantly easier.

We’re seeing climate disclosure regulations happening across the board in Asia, North America, and Europe.

What challenges and opportunities do you experience as an impact-driven company?

When you can align the opportunity to create great financial value with societal impact, that’s a really powerful way to build unprecedented solutions. And at the end of the day, people want to feel good about who they’re doing business with. If you’re investing in a mission-oriented company, It’s not just this vague concept. There are clear correlative impacts in the real world.

In terms of the cons, perception is still a challenge. Do you have to choose between making an impact with your business model or creating financial value for your stakeholders? The answer used to be yes, and there are still many capitalists out there who believe that. Also, while trillions of dollars have now been allocated towards ESG and climate-focused companies, we’re still in the relatively early stages of the impact investing life cycle. There are certainly challenges that come with that, though I would say that’s true of nascent markets across the board and not necessarily unique to impact investing.

While trillions of dollars have now been allocated towards ESG and climate-focused companies, we’re still in the relatively early stages of the impact investing life cycle.

What is next on the horizon for your organization, and how can our community support you?

We always welcome referrals on both sides of that coin: talent and customers. The biggest way you can help us right now is to send us great people. We’re in an enormously competitive labor market defined by a huge shortfall of talent. There just aren’t enough engineers, designers, and scientists across the board.

Visit our job board to browse dozens of open positions at Persefoni. If you find a match, fill out this short form, and we will make a personal referral.

We actually have a standing rule: If we have somebody that’s smart and capable but we don’t have a job open for them, we will find and make a role, because getting great people that want to build is absolutely critical.

And of course, customers are always great. We’ve had great success with finding high velocity and great quality customer referrals from the Alumni Ventures network.

Why did you decide to partner with Alumni Ventures? What makes us stand out?

Alumni Ventures has built a great network that comes together to support young companies across a multitude of stages in their journey. Who wouldn’t want that on their cap table? Another thing that stuck out was the long-term vision of the investing team. From day one, the team had a huge appetite to learn with us along the way, which is a really important characteristic we look for in our investors.

Want to learn more?

View all our available funds and secure data rooms, or schedule an intro call.

New to AV?

Sign up and access exclusive venture content.

Contact [email protected] for additional information. To see additional risk factors and investment considerations, visit av-funds.com/disclosures.