5 Questions with Axiom Space

Axiom Space was selected by NASA to build a replacement for the International Space Station, which will offer more advanced components to aid in commercializing low-Earth orbit.

We’re pleased to highlight Axiom Space, part of Alumni Ventures’ current Deep Tech Fund 2020 portfolio. This annual fund consists of about 20-30 diversified investments in private companies tackling the toughest and potentially most lucrative tech challenges.

It’s an example of the type of investments we are aiming to provide investors in our 2021 Deep Tech vintage with diversification similar to that in our 2020 Deep Tech portfolio.

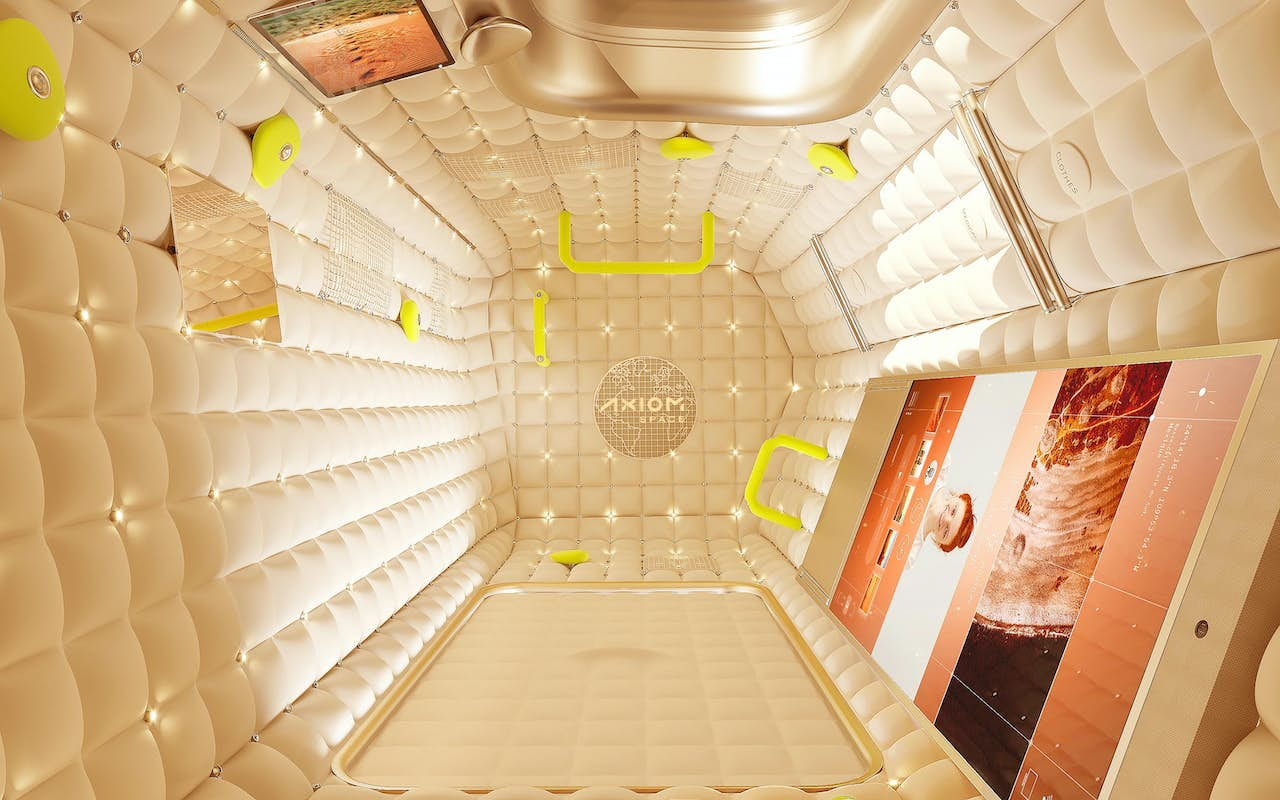

Axiom Space is an aerospace company selected by NASA to build a replacement for the International Space Station while leveraging the existing ISS infrastructure. In 2020, Axiom received $140 million in initial NASA contracts to begin the design and development process of Axiom Station, which will offer more advanced components to aid in commercializing low-Earth orbit.

See below for an interview with Amir Blachman, Axiom’s Chief Business Officer. Blachman was Axiom’s first full-time employee and has been responsible for financial planning, fundraising, corporate venture, marketing, and business development.

Amir Blachman, Chief Business Officer

Amir Blachman has over 20 years of investment finance, corporate growth, board management, compliance, and transactional experience. He served as Managing Director of a space investment syndicate with 120 investors in 11 countries and was responsible for funding companies that developed lunar landers, communication networks, Earth-imaging satellites, antennae, and exploration technologies. Prior to merging his investment and aerospace backgrounds, Blachman had a successful career in real estate investment and lending. His capabilities as a practical, mission-focused operator were honed during his service as an Air Force instructor. He holds a BA in Psychology from UC Santa Barbara and an MBA from UCLA Anderson.

1) What problem or opportunity is Axiom addressing?

There’s a growing need for human-tended platforms in Earth’s orbit to support the accelerating number of global exploration endeavors — zero gravity research, manufacturing, and other markets ranging from climate science to communications. The problem is that the International Space Station (ISS) — which is the only platform in Earth’s orbit right now — is set up for research, not for commercial human space flight and certainly not for manufacturing at scale. The ISS is approaching the end of its 30-year useful life, and any extension of the station really wouldn’t be cost effective.

Axiom is building a much more efficient and capable successor space station. The ISS was built for about $100 billion, and our station will cost just over $3 billion. We are the only company in the world that is authorized to connect our station to the ISS. Our first crew started training on the ISS in January 2020, and in 2024, the first part of the new space station that we’re building will launch into orbit. From 2028 to 2030, the ISS will disconnect from us, and our station will be the new cornerstone of human activity in Earth’s orbit. We’ve adopted the multi-billion-dollar annual opportunity that came with the current ISS user base, which will grow into a trillion-dollar market.

Alumni Ventures’ Deep Tech Fund offers a portfolio of ~20-30 diverse companies tackling the toughest and potentially most lucrative tech challenges. Recent events have underscored the critical importance of science and rational thought for the well-being of society and the planet.

To learn more, click below to review fund materials or book a call with a Senior Partner.

2) What challenges and opportunities do you experience as a deep tech company?

One of our biggest challenges is vertical integration. Is there a solution that’s off-the-shelf enough to suit what we need? Is there a company out there capable of building it for us? Or do we need to build that capability in-house?

And that’s just in terms of hardware. When we’re hiring and training people, we need to decide what we want to farm out and what we keep in-house. What we’re doing can’t be done by just any team. In the last 12 months, we’ve grown from 50 to 200 employees, including five of America’s most accomplished astronauts. We’re on track to exceed 300 employees by the end of the year.

Lastly, a challenge for something of this magnitude is capitalization. We want to be the first aerospace company in history to deliver a major program on time and under budget. So far, we are on track to do that. But completing this type of project takes capital. At the beginning, raising that capital was challenging. The investment world now understands that we’re not building a Bates Motel in space. We’re building something that serves countries around the world, that supports diplomatic relationships among countries, and delivers innovations that will change multiple industries.

3) Why is Axiom a good fit for Alumni Ventures’ Deep Tech portfolio?

There aren’t many tech challenges that are more complex than building a space station. We’ve tackled significant challenges, had our technical design vetted by both by our space agency partners and investors, been selected by NASA to replace the ISS, and raised the capital to fund the project. That gives us a multi-billion-dollar barrier to competitors and a steep learning curve advantage. We have relationships with NASA and the U.S. government, our customers, launch providers, and many suppliers that are helping us build the station. That sets up a competitive moat that will last for at least 10 to 15 years.

And that’s on the complexity side. In terms of how lucrative this opportunity is, we have seven main revenue streams:

- Professional astronauts funded by space agencies

- Private astronauts who are ultra-high-net-worth individuals or corporate-sponsored

- Research opportunities

- Manufacturing opportunities

- Companies testing their deep space exploration systems in Earth’s orbit

- STEM and media outreach, including films, advertising, and educational opportunities

- Deploying and servicing satellites, as well as supporting the processing and storage of data on orbit.

Then there’s the quality of these revenue streams. These are countries, corporations, and ultra-high-net-worth individuals as customers. If each of these revenue streams are recurring, they have the potential to grow into the single-digit billions over the next two years and double-digit billions into the 2030s.

4) What are some reasons deep tech companies like yours might be attractive to investors?

We’re building an enabling platform with broad applicability, which I would argue is the most exciting platform for innovation and commercialization since the Internet. That’s a big claim, but we are, for the first time in history, opening up microgravity to every industry on Earth in a way that’s cost effective and accessible, while still serving the legacy existing space agency user base.

This is an industry with very high barriers to competitors. We have a good decade where there really are not going to be a lot of other players that can significantly compete with us. And as those competitors come on line, we will be at the heart of a burgeoning economy. There is room for other players. We have some great global partnerships in the works with some of the biggest corporations on the planet that want to represent us in other parts of the world. That’s going to be a significant accelerator in getting research and manufacturing customers on board. We have over 80 companies in our research and manufacturing pipeline, and about 20 of those companies are in contract negotiation with us and several are already contracted.

5) Why did you decide to work with Alumni Ventures? What makes us stand out as a VC partner?

Alumni Ventures really accepted us with open arms. They connected us with a broad network of investors in their university networks across the United States. If we had tried to reach out to each of those investors individually, it would have been a major effort.

Additionally, Alumni Ventures’ investment process has been highly defined. Their due diligence is efficient yet thorough, the investment criteria were transparent and consistent, and the investment timelines were known. When we opened a new round, Alumni Ventures told us, “This is how long it will take to go through the preliminary due diligence, this is how we invest if we’re doing a convertible note, this is how we invest if we’re purchasing equity, and these are the types of questions that you can expect to be asked by our Investment Committee.” And they stuck to that timeline and methodology. They have also been advocates for us in their conversations with other investors and the general public.

On-Demand Webinar

Our Deep Tech Fund offers investors an easy way to own a variety of venture investments across deep tech sectors. To learn more about the fund, watch an on-demand recording from our recent fund overview webinar hosted by Alumni Ventures’ CEO Mike Collins and CIO Anton Simunovic.

Contact [email protected] for additional information. To see additional risk factors and investment considerations, visit av-funds.com/disclosures.