3 Reasons to Diversify With VC

Elite Endowments Use VC To Diversify. Now You Can Too.

Venture capital investing is no longer just for institutions. Alumni Ventures is designed to let you join forces with other accredited investors, access professional-grade investments, and diversify your portfolio beyond public markets.*

- Home

A Tool for Diversification

- Home

VC Largely Is Uncorrelated to Public Markets

- Home

No Longer Just for Institutions

View Fund Performance

Login to our secure data room.

Schedule a Call to Speak with Us

Ask questions important to you.

1. Elite Endowments Use VC To Diversify

A key long-term investing strategy of university endowments is diversifying across multiple asset classes — including venture capital. One of the main reasons institutional investors include venture capital as a sizable portion of their portfolio is that venture is a long-term investment that can provide returns and diversification.**

Yale Endowment as of June 30, 2021 1, 2

The Yale endowment earned 40.2% investment return in FY 2021.3

1. Financial Report 2020–2021 Yale University, Investments at NAV as of June 30, page 38

2. The Yale Endowment, 2021, Endowment Market Value, page 2

3. “Yale endowment earns 40.2% investment return in FY 2021,” Yale News, Oct. 14, 2021

A key long-term investing strategy of university endowments is diversifying across multiple asset classes — including venture capital. In fact, diversifying across multiple asset classes is a key reason why the top five Ivy League endowments are valued at $213 billion.

VC 101: Why VC for Diversification

AV’s VC 101 video series provides insights on venture capital essentials. In this episode, our team explores how venture capital can provide valuable diversification to an investment portfolio.**

See video policy below.

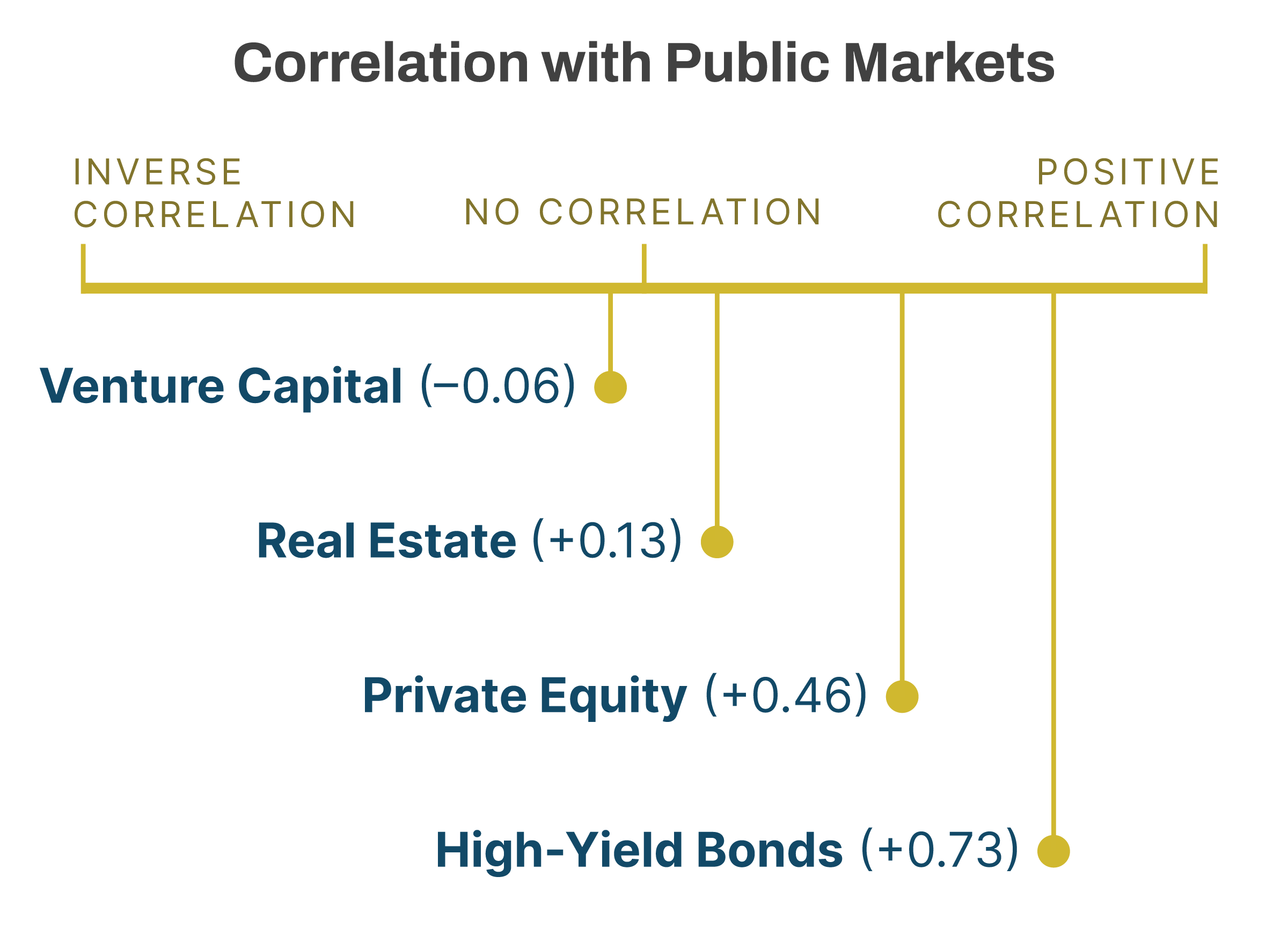

2. Venture Capital Is Largely Uncorrelated to Public Markets

It can also provide a welcome balance for your investments, particularly when the stock market is in turmoil. Venture capital is less impacted by the ups and downs of the stock market, in part because it is longer term. Click here to learn why some of the world’s largest pension funds are turning to venture.

Venture Capital Is Largely Uncorrelated to Public Markets1

Venture capital is less impacted by the ups and downs of the stock market, in part because it is longer term.

1. TopTier Capital Partners, “The Inverse Correlation Between Venture and Public Markets,” TTCP Blog, March 2, 2016

2. Invesco, “The Case for Venture Capital,” Invesco White Paper Series, accessed January 11, 2022

3. Venture Capital Is No Longer Just for Institutions

Alumni Ventures is one of the world’s most active VCs. Our funds allow you to align yourself with communities from prestigious schools like Harvard, Stanford, MIT, and Northwestern and invest in a large diversified fund, co-investing alongside established VCs.***

If you’re ready to consider adding VC to your portfolio, click below to read or watch info on the fund or connect with us to talk. We look forward to discussing what VC and Alumni Ventures have to offer.

View Fund Performance

Login to our secure data room.

Schedule a Call to Speak with Us

Ask questions important to you.

*The manager of the AV Funds is Alumni Ventures (AV), a venture capital firm. AV and the funds are not affiliated with or endorsed by any college or university. These investments are for illustration purposes only. These investments are not intended to suggest any level of investment returns; not necessarily indicative of investments invested by any one fund or investor. Many returns in investments result in the loss of capital invested. These investments are not available to future fund investors except potentially in certain follow-on investment options. No Ivy League university endowment is invested in any fund organized by AV.

**Diversification is a strategy used to help mitigate risk but cannot ensure a profit or protect against loss in a declining market. Different types of investments involve varying degrees of risk, and this fund involves substantial risk of loss, including loss of all capital invested.

***Co-investors listed are for illustration purposes only. These co-investors are some that AV has historically co-invested with and is not a predictor of future co-investors for any given portfolio company. There is no guarantee of who will be the co-investors in any given investment and these investments are not intended to suggest any level of investment returns; not necessarily indicative of investments invested by any one fund or investor. Many returns in investments result in the loss of capital invested.

Contact [email protected] for additional information. To see additional risk factors and investment considerations, visit av-funds.com/disclosures.