Professional-Grade Venture Capital Portfolios for Individuals

Hello Smart Venture Listeners!

As a listener of the Smart Venture podcast, you are diligent about learning the latest in tech and investing. You might also be interested in learning how you can gain access to investing in venture capital which has historically been off-limits to individuals.

As America’s largest venture capital firm for individual investors, Alumni Ventures gives you this access to invest in professional-grade venture portfolios.

Schedule a complimentary intro call below to learn more today.

Book a 15-minute Intro Call to Learn More

Why consider adding VC to your portfolio?

- HomeVenture consistently outperforms the public markets, including the 5, 15, and 25-year time periods. (3)

- HomeVenture has been the highest-performing alternative asset class over the last decade. (4)

- HomeVenture returns are largely uncorrelated to the public markets. (5)

- HomeUncorrelated assets can reduce the risk of an overall portfolio, and provide downside protection when public markets are down or choppy.

Why consider Alumni Ventures?

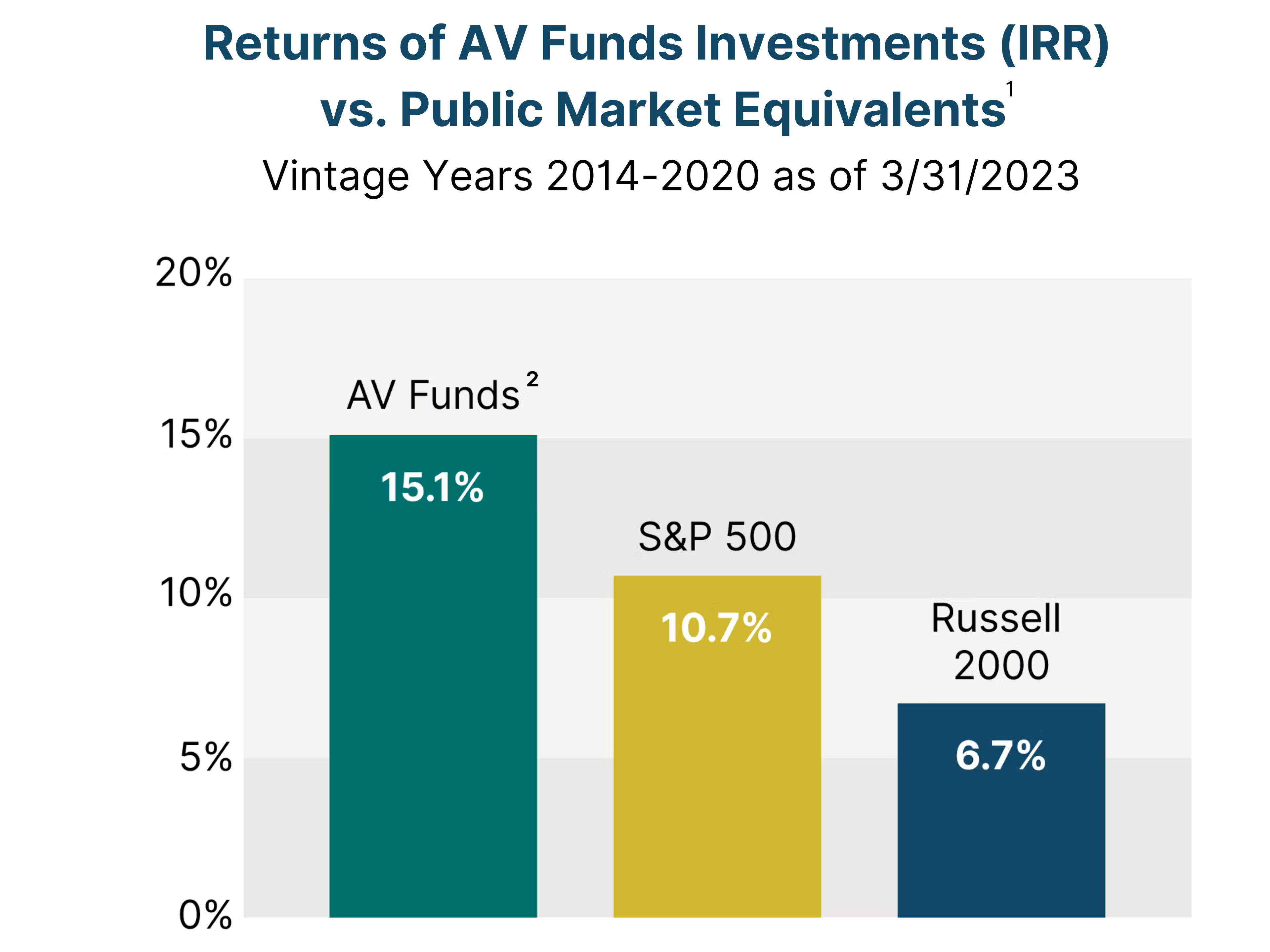

- HomeOur funds significantly outperform public market equivalents.

- HomeWe are America’s largest venture firm for individual investors.

- Home#1 most active venture firm in the U.S. (Pitchbook 2022)

Sign Up to Learn More

Our Story, told by Founder & CEO, Mike Collins

- HomeFounded in 2014

- HomeMission: Democratize Venture Capital

- HomeProfessional-Grade Venture Portfolios

- Home#1 Most Active Venture Firm in the U.S.

See video policy below.

A Venture Fund for Every Objective

Explore Our Fund Types

(1)The aggregate performance of the AV venture funds is not necessarily representative of the performance of any particular AV venture fund or the experiences of any individual AV investor. All investment involves risk, including risk of loss. Not all venture capital investments will be successful. Past performance is not necessarily reflective of future results, and achievement of investment objectives, including preservation of principal, cannot be guaranteed.

(2) IRR for AV Funds includes Uninvested Cash, Unrealized Investments, and Amounts Distributed to Investors. IRR for AV Funds is net of management fees, and net of incentive allocations applied to amounts distributed to investors, but gross of incentive allocations applicable to unrealized gains on investments held by AV Funds. For additional information, please see here. The IRR shown for S&P 500, and Russell 2000 indices are gross of fees because indices are not managed investments. It is not possible to invest directly in an index.

(3) Cambridge Associates, Building Winning Portfolios through Private Investments, August 2021

(4) JP Morgan Asset Management, Guide to Alternatives, Q4 2022 Report

(5) Invesco Research, The Case For Venture Capital, 2016